| Foreign exchange |

|---|

| Exchange rates |

| Markets |

| Assets |

| Historical agreements |

| See also |

A managed float regime, also known as a dirty float, is a type of exchange rate regime where a currency's value is allowed to fluctuate in response to foreign-exchange market mechanisms (i.e., supply and demand), but the central bank or monetary authority of the country intervenes occasionally to stabilize or steer the currency's value in a particular direction. This is in contrast to a pure float where the value is entirely determined by market forces, and a fixed exchange rate where the value is pegged to another currency or a basket of currencies.

Under a managed float regime, the central bank might buy or sell its own currency in the foreign exchange market to counteract short-term fluctuations, to prevent excessive depreciation or appreciation, or to achieve certain economic goals such as controlling inflation or boosting exports.

In an increasingly integrated world economy, the currency rates impact any given country's economy through the trade balance. In this aspect, almost all currencies are managed since central banks or governments intervene to influence the value of their currencies. According to the International Monetary Fund, as of 2014, 82 countries and regions used a managed float, or 43% of all countries, constituting a plurality amongst exchange rate regime types.[1]

International financial organizations, like the IMF, categorize countries' exchange rate regimes based on specific criteria, but these classifications aren't necessarily objective and may not fully capture the nuances of a country's exchange rate policies. For example, a country may normally have a floating exchange rate regime but intervene in times of extreme volatility, a country may formally claim to be following one exchange rate regime (de jure) while having another in practice (de facto).

United States for instance, claims to follow a floating exchange rate regime and does not typically engage in direct intervention to set exchange rates. However, its economic policies, the role of the U.S. Dollar as a global reserve currency, and the sheer size of the US economy give it a significant indirect influence on global exchange rates and financial markets.

For more detail on each countries' exchange rate regime it is recommended to read IMF's Annual Report on Exchange Arrangements and Exchange Restrictions.

List of countries with managed floating currencies

- Source IMF as of April 31, 2008

Afghanistan

Afghanistan Algeria

Algeria Argentina

Argentina Armenia

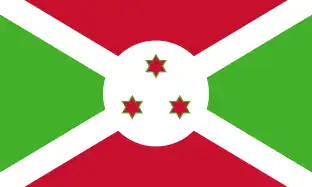

Armenia Burundi

Burundi Cambodia

Cambodia Colombia

Colombia Dominican Republic

Dominican Republic Egypt

Egypt Ethiopia

Ethiopia Gambia

Gambia Georgia

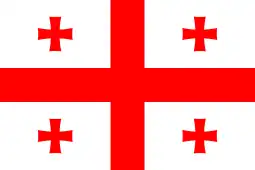

Georgia Ghana

Ghana Guatemala

Guatemala Guinea

Guinea Haiti

Haiti Indonesia

Indonesia Jamaica

Jamaica Japan[2]

Japan[2] Kenya

Kenya Kyrgyzstan

Kyrgyzstan Laos

Laos Liberia

Liberia Madagascar

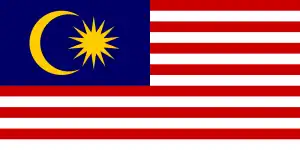

Madagascar Malaysia

Malaysia Mauritania

Mauritania Mauritius

Mauritius Moldova

Moldova Morocco

Morocco Mozambique

Mozambique Myanmar

Myanmar Nigeria

Nigeria Pakistan

Pakistan Papua New Guinea

Papua New Guinea Paraguay

Paraguay Peru

Peru Romania

Romania São Tomé and Príncipe

São Tomé and Príncipe Serbia

Serbia Singapore

Singapore Sudan

Sudan Taiwan

Taiwan Tanzania

Tanzania Thailand

Thailand Trinidad and Tobago[3]

Trinidad and Tobago[3] Uganda

Uganda Ukraine

Ukraine Uruguay

Uruguay Vanuatu

Vanuatu

See also

- December Mistake

- Black Wednesday

- Fixed exchange rate

- Floating exchange rate or Floating currency

References

- ↑ "IMF finds more countries adopting managed floating exchange rate system". Nikkei Asian Review. Nikkei. August 19, 2014. Retrieved 5 March 2015.

- ↑ Japanese yen

- ↑ "Floating of the TT dollar: 20 years later". Trinidad Express Newspaper. April 2, 2013. Archived from the original on April 5, 2013.