| |

| Headquarters | 12 Neglinnaya str., Moscow, Russian Federation |

|---|---|

| Coordinates | 55°45′47″N 37°37′17″E / 55.76306°N 37.62139°E |

| Established | 1860 (original institution) July 13, 1990 (Bank of RSFSR) December 25, 1991 (current name) |

| President | Elvira Nabiullina |

| Central bank of | |

| Currency | Russian ruble RUB (ISO 4217) |

| Reserves | 608.2 billion USD (As of 9 April 2022)[2] |

| Reserve requirements | International Reserves |

| Bank rate | 16.0% [3] |

| Preceded by | State Bank of the USSR (between 1922 and 1991) |

| Website | cbr.ru/eng |

The Central Bank of the Russian Federation (CBR; Russian: Центральный банк Российской Федерации),[4][5][6] doing business as the Bank of Russia (Russian: Банк России),[7][8] is the central bank of the Russian Federation. The bank was established on July 13, 1990.[6] The predecessor of the bank can be traced back to the State Bank of the Russian Empire founded in 1860.[9]

The bank is headquartered on Neglinnaya Street in Moscow. Its functions are described in the Constitution of Russia (Article 75)[10] and in federal law.

History

| Timeline of central banking in Russia | |

|---|---|

| Dates | System |

| 1769–1818 | State Assignation Bank |

| 1818–1860 | State Commercial Bank |

| 1860–1917 | State Bank of Russia |

| 1917–1922 | People's Bank of the RSFSR |

| 1922–1991 | State Bank of the USSR |

| 1991–present | Central Bank of Russia |

| Sources:[11] | |

| This article is part of a series on |

| Banking in the Russian Federation |

|---|

|

|

|

Russia portal |

State Bank of the Russian Empire

The decision to create a State Bank of the Russian Empire was made by Emperor Peter III in May 1762,[13] which was modeled on Bank of England and would have the right to issue bank notes. However, due to the coup on 28 June 1762 and the murder of the Czar, the project was not implemented. The outbreak in 1768 of the Russian-Turkish War and deficit of the state budget forced Catherine II, in turn, refer to the idea of issuing a paper money, and in December 1768 she formed the State Assignation Bank, which existed until 1818 and was replaced by the State Commercial Bank, but the first central banking body in Russia was established on 12 June [O.S. 31 May] 1860 as The State Bank (GosBank) of the Russian Empire (Russian: Государственный банк Российской Империи) which was formed on the base of the State Commercial Bank by ukaz of Emperor Alexander II. This ukaz also ratified the statutes of the bank. According to the statutes, it was a state-owned bank, intended for short-term credit of trade and industry.

In early 1917 the bank had eleven branches, 133 permanent and five temporary offices and 42 agencies. On 7 November 1917 the Russian State Bank was disestablished and replaced by The People's Bank which existed until the establishment of the Soviet Gosbank.

State Bank of the Soviet Union

The Central Bank of the Russian Federation

The Central Bank of the Russian Federation (Bank of Russia) was established 13 July 1990 as a result of the transformation of the Russian Republican Bank of the State Bank of the USSR. It was accountable to the Supreme Soviet of the RSFSR. On 2 December 1990, the Supreme Soviet of the RSFSR passed the Law on the Central Bank of the Russian Federation (Bank of Russia), according to which the Bank of Russia has become a legal entity, the main bank of the RSFSR and was accountable to the Supreme Soviet of the RSFSR. In June 1991, the charter was adopted by the Bank of Russia. On 20 December 1991 the State Bank of the USSR was abolished and all its assets, liabilities and property in the RSFSR were transferred to the Central Bank of the Russian Federation (Bank of Russia), which was then renamed to the Central Bank of the Russian Federation (Bank of Russia). Since 1992, the Bank of Russia began to buy and sell foreign currency on the foreign exchange market created by it, establish and publish the official exchange rates of foreign currencies against the ruble.

Role and duties

According to the constitution, it is an independent entity, with the primary responsibility of protecting the stability of the national currency, the ruble.[14]

Before 1 September 2013, it was the main regulator of the Russian banking industry, responsible for banking licenses, rules of banking operations and accounting standards, serving as a lender of last resort for credit organizations. After pointed date functions and powers of CBR were significantly expanded and the central bank received the status of a mega-regulator of all financial markets of Russia.[15]

It holds the exclusive right to issue ruble banknotes and coins through the Moscow and St. Petersburg mints, the Goznak mint. The central bank issues commemorative coins made of precious and non-precious metals as well as investment ones made of precious metals, which are distributed inside and outside the country.[16] In 2010, in honor of its 150th anniversary it issued a 5-kilo commemorative gold coin Alexander II.[17]

Under Russian law, half of the bank's profit must be channeled into the government's federal budget. The Central Bank of Russia is a member of the BIS.[18]

The Bank of Russia owns a 57.58% stake in Sberbank, the country's leading commercial bank. The Bank of Russia owns as well 100% stake in Russian National Reinsurance Company (RNRC), biggest national reinsurance company. RNRC was established in July 2016 for prevention possible problems with abroad reinsurance of large risks under International sanctions during the Ukrainian crisis, like constructing the Crimean Bridge.[19]

Anti-fraud activities

A key prospective witness in improper financial affairs was Lyubov Tarasova (Russian: Любовь Тарасова) who was a senior auditor for the Central Bank of Russia and worked for the "Unicom" (Russian: "Юникон") auditing firm which had been established on 20 August 1991 and was responsible for "checking the correctness of the documentation and the essence of business transactions that are in doubt" (Russian: "проверка правильности документального оформления и сущности хозяйственных операций, вызывающих сомнение"), but was stabbed to death in her apartment in Moscow on 15-16 October 1997.[20][21][22]

In 2017, within the framework of a joint anti-phishing project of the Bank of Russia and search engine Yandex, a special check mark (a green circle with a tick and 'Реестр ЦБ РФ' (Bank of Russia Register) text box) appeared in the search results, informing the consumer that the website is really owned by a legally registered company licensed by the Bank of Russia.[23][24]

Chairmen

Governors of the State Bank

The governor was appointed by the emperor of Russia.

| № | Name (governor) | Photo | Term of office | Appointed by | |

|---|---|---|---|---|---|

| Start of term | End of term | ||||

| 1 | Alexander von Stieglitz |  |

10 June 1860 | 1866 | Alexander II |

| 2 | Evgeniy Lamanskiy |  |

1866 | 1881 | |

| 3 | Alexey Tsismen |  |

1881 | 1889 | Alexander III |

| 4 | Yuliy Zhukovskiy |  |

1889 | 1894 | |

| 5 | Eduard Pleske |  |

1894 | 1903 | Nicholas II |

| 6 | Sergey Timashev |  |

1903 | 1909 | |

| 7 | Alexey Konshin |  |

1909 | 1914 | |

| 8 | Ivan Shipov |  |

1914 | 1917 | |

Chairman of the board of the USSR State Bank

The chairman was appointed by the Premier of the Soviet Union.

| № | Name (governor) | Photo | Term of office | Appointed by | |

|---|---|---|---|---|---|

| Start of term | End of term | ||||

| 1 | Aron Sheinman[25] | .svg.png.webp) |

1921 | 1924 | Vladimir Lenin |

| 2 | Nikolai Tumanov | .svg.png.webp) |

5 March 1924 | 16 January 1926 | Alexei Rykov |

| 3 | Georgy Pyatakov |  |

19 April 1929 | 18 October 1930 | |

| 4 | Moissei Kalmanovich | .svg.png.webp) |

18 October 1930 | 4 April 1934 | Vyacheslav Molotov |

| 5 | Lev Maryasin | .svg.png.webp) |

4 April 1934 | 14 July 1936 | |

| 6 | Solomon Kruglikov | .svg.png.webp) |

14 July 1936 | 15 September 1937 | |

| 7 | Alexey Grichmanov |  |

15 September 1937 | 16 July 1938 | |

| 8 | Nikolai Bulganin | 2 October 1938 | 17 April 1940 | ||

| 9 | Nikolai K. Sokolov | .svg.png.webp) |

17 April 1940 | 12 October 1940 | |

| 10 | N. Bulganin | 12 October 1940 | 23 May 1945 | Joseph Stalin | |

| 11 | Yakov Golev | .svg.png.webp) |

23 May 1945 | 23 March 1948 | |

| 12 | Vasily Popov | .svg.png.webp) |

23 March 1948 | 31 March 1958 | Georgy Malenkov and Nikolai Bulganin  |

| 13 | N. Bulganin |  |

31 March 1958 | 15 August 1958 | Nikita Khrushchev |

| 14 | Alexander Korovushkin | .svg.png.webp) |

15 August 1958 | 14 August 1963 | |

| 15 | Alexey Poskonov | .svg.png.webp) |

1963 | 1969 | Alexei Kosygin |

| 16 | Miefodiy Svieshnikov | .svg.png.webp) |

1969 | 1976 | |

| 17 | Vladimir Alkhimov | .svg.png.webp) |

11 October 1976 | 10 January 1986 | Nikolai Tikhonov |

| 18 | Viktor Dementsev | .svg.png.webp) |

10 January 1986 | 22 August 1987 | Nikolai Ryzhkov |

| 19 | Nikolai Garetovsky | .svg.png.webp) |

22 August 1987 | 7 June 1989 | |

| 20 | Viktor Gerashchenko |  |

7 June 1989 | 26 August 1991 | Valentin Pavlov |

| 21 | Andrei Zverev | .svg.png.webp) |

26 August 1991 | 20 December 1991 | Ivan Silayev |

President of the Central Bank of Russia

| President of the Board of Governors of the Central Bank | |

|---|---|

| Appointer | President of Russia |

| Formation | 31 May 1860 |

| First holder | Alexander von Stieglitz |

| Website | Bios |

The President of the Board of Directors of the Central Bank is the head of the central banking system of the Russian Federation. The Head is chosen by the President of Russia; and serves for four-year-terms after appointment. A Head may be appointed for several consecutive terms (Sergey Ignatyev was the Governor of the Central Bank for 11 years, and he was appointed three times, in the longest serving term in post-soviet Russia).

| № | Name (governor) | Photo | Term of office | Appointed by | |

|---|---|---|---|---|---|

| Start of term | End of term | ||||

| 1 | Georgy Matyukhin |  |

25 December 1990 | 16 May 1992 | Boris Yeltsin |

| 2 | Viktor Gerashchenko |  |

17 July 1992 | 18 October 1994 | |

| 3 | Tatyana Paramonova |  |

19 October 1994 | 8 November 1995 | |

| 4 | Alexander Khandruyev |  |

8 November 1995 | 22 November 1995 | |

| 5 | Sergei Dubinin |  |

22 November 1995 | 11 September 1998 | |

| 6 | Viktor Gerashchenko |  |

11 September 1998 | 20 March 2002 | |

| 7 | Sergei Ignatyev |  |

21 March 2002 | 23 June 2013 | Vladimir Putin |

| 9 | Elvira Nabiullina |  |

24 June 2013 | present | |

Subsidiaries

.jpg.webp)

The Central Bank of Russia holds directly significant participatory interests in a number of Russian companies:

- Sberbank of Russia (50%+1 voting share of the stock);

- Moscow Exchange (11.779% of the stock);

- Russian National Reinsurance Company (100% of the stock);

- Trust company of the Banking Sector Consolidation Fund (100% of the stock);

- Rosincas (Russian Association of Cash-in-transit).

Additionally, the Bank of Russia held earlier interests in some other Russian organizations. In particular, after the liquidation of Gosbank (State Bank of the USSR), the CBR beneficially acquired complete or controlling interests in five so-called "Russian Foreign Banks" (until 1991 – "Soviet Foreign Banks"):

- VTB Bank (99.99% of the stock – until 2002, now - 60.9% owned by The Federal Agency for State Property Management (Rosimushchestvo) );

- Donau Bank AG, Vienna;

- East-West United Bank, Luxemburg;

- Eurobank, Paris;

- Moscow Narodny Bank, London;

- Ost-West Handelsbank, Frankfurt am Main.

All of them were members of the USSR Vneshekonombank system and were transferred to the CBR in 1992 by the Resolution of the Presidium of the Supreme Soviet of Russia.[26] For over five years – 2000 to 2005 – all stocks of the Russian Foreign Banks were being purchased from the Bank of Russia by VTB Bank.[27][28][lower-alpha 1] As part of the financial support to credit institutions, the Bank of Russia invests in them through the Banking Sector Consolidation Fund and acquires (on a temporary and indirect basis) shares in the equity of such banks. The first project of this kind was Otkritie FC Bank, in summer 2017.

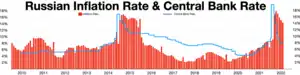

Politics

In December 2014, amidst falling global oil prices, Western sanctions over the Ukraine crisis, capital flight, and fears of recession, the bank had increased the one-week minimum auction repo rate up by 6.5 points to 17 percent. This caused a run on the ruble, and on 29 January, the bank decreased the rate by two points to 15 percent.

In January 2015, the head of monetary policy, Ksenia Yudayeva, a proponent of strict anti-inflation policy, was replaced by Dmitry Tulin, who is "seen as more acceptable to bankers, who have called for lower interest rates".[30]

In response to the 2021–2022 Russo-Ukrainian crisis, multiple countries imposed economic sanctions against Russian banks. On 22 February 2022, US president Joe Biden announced restrictions of activities by US citizens involved with the Bank of Russia and others.[31] In March, the Bank of International Settlements suspended the Bank of Russia.[32] In March 2022, the Depository Trust & Clearing Corporation blocked Russian securities from the Bank of Russia and Russia's finance ministry.[33] At the end of May 2022, three months into the invasion of Ukraine, the central bank cut interest rates in an effort to prop up the increasingly isolated Russian economy, suffering shortages and supply chain issues. The inflation rate rose to 17.8 percent in April. Also the ruble reached its strongest level against the U.S. dollar in four years, hurting exports.[34]

Sanctions also included asset freezes on the Russian Central Bank,[35] which holds $630 billion in foreign-exchange reserves,[36] to prevent it from offsetting the impact of sanctions.[37] On 5 May 2022, President of the European Council Charles Michel said: "I am absolutely convinced that this is extremely important not only to freeze assets but also to make possible to confiscate it, to make it available for the rebuilding" of Ukraine.[38]

See also

Notes

- ↑ In 1998, "Northern Alliance" (Russian: «Северный Альянс») associated with Saint Petersburg included directors and shareholders of Tokobank (Russian: Токобанк) including Sudhir Gupta, owner of Amtel Tire Holding and controlled Yunicbank (Russian: Юникбанк), whose August 1998 head of the supervisory board was Stepan Kovalchuk (Russian: Степан Ковальчук), the chairman of the board of Flamingo Bank (Russian: банк «Фламинг»). Stepan Kovalchuk is a grand-nephew of Yuri Kovalchuk.[27][28][29]

References

- ↑ Weidner, Jan (20 April 2017). "The Organisation and Structure ofCentral Banks" (pdf). portal.dnb.de. Darmstadt: Technische Universität Darmstadt. p. 296. Retrieved 21 December 2021.

- ↑ Central Bank of The Russian Federation. "International Reserves of the Russian Federation (End of period)". Retrieved 1 March 2022.

- ↑ "The Central Bank of Russian Federation | Bank of Russia". www.cbr.ru.

- ↑ "Constitution of the Russian Federation". Government of the Russian Federation archive.government.ru. Retrieved 28 May 2022.

- ↑ "Конституция Российской Федерации / Constitution of the Russian Federation (in Russian)". Government of the Russian Federation archive.government.ru. Retrieved 28 May 2022.

- 1 2 "Federal Register / Vol. 87, No. 42 / Thursday, March 3, 2022 / Notices" (PDF). United States Department of the Treasury. 3 March 2022. Retrieved 27 May 2022.

- ↑ "About Bank of Russia | Bank of Russia". cbr.ru. Retrieved 28 May 2022.

- ↑ "О Банке России | Банк России". cbr.ru. Retrieved 28 May 2022.

- ↑ History of the Bank of Russia. 1860–2010. In 2 vols. Ed.: Y. A. Petrov, S. Tatarinov. 2010.

- ↑ "Constitution of the Russian Federation". Government of the Russian Federation archive.government.ru. Retrieved 28 May 2022.

- ↑ CBR. "Bank of Russia Today:History".

- ↑ "Рейтинг банков | Банки.ру". Banki.ru. Retrieved 3 January 2020.

- ↑ Об учреждении Государственного банка [On the establishment of the State Bank] (in Russian) (Полное собрание законов Российской империи с 1649 года ed.). СПб.: Типография II отделения Собственной Его Императорского Величества канцелярии. 1830. pp. 1021–1023.

- ↑ Bank of Russia:Banking Legislation.

- ↑ "Elvira Nabiullina: Establishing a mega regulator for the Russian financial sector", Bank for International Settlements : Central bankers' speeches : Speech by Ms Elvira Nabiullina, Governor of the Bank of Russia, at the Federation Council, Moscow, 15 February 2017.

- ↑ "Commemorative Coins – Banknotes and Coins – Bank of Russia". cbr.ru.

- ↑ "Russia to issue 5 kg gold coin" Archived 23 May 2010 at the Wayback Machine, The Financial Express. 19 May 2010. Accessed 19 May 2010.

- ↑ Hilsenrath, Jon; Blackstone, Brian (12 December 2012). "Inside the Risky Bets of Central Banks". wsj.com. The Wall Street Journal. Retrieved 21 December 2021.

- ↑ "Putin signed a law establishing a National reinsurance company" Archived 27 May 2020 at the Wayback Machine, World News, Breaking News, 4 July 2016.

- ↑ "Arthur Christy. Inkombank lawyer former US Attorney: US lawyers hired as spin doctors for Russian mob". US-Russia Press Club. 30 April 1999. Archived from the original on 1 July 2007. Retrieved 10 April 2021 – via russianlaw.org.

- ↑ "Убили аудитора: Убит хранитель тайн Центробанка" [The auditor was killed: Keeper of secrets of the Central Bank killed]. Kommersant (in Russian). 18 October 1997. Retrieved 8 April 2021.

- ↑ "били аудитора: Кого проверяла Любовь Тарасова" [The auditor was killed: Whom Lyubov Tarasova checked]. Kommersant (in Russian). 18 October 1997. Retrieved 10 April 2021.

- ↑ "Bank of Russia to mark microfinance organisations on the Internet | Банк России". www.cbr.ru. Retrieved 16 August 2017.

- ↑ "Insurers' websites receive first marks | Банк России". www.cbr.ru. Retrieved 14 February 2018.

- ↑ "The State Bank of the USSR". Bank of Russia Today. Bank of Russia. Retrieved 26 May 2015.

- ↑ Овчинников, О. (Ovchinnikov, O.) (8 November 2000). "ЦБ - центральный Банд ..." [Central Bank - Central Gang ...]. Compromat.ru (in Russian). Retrieved 10 April 2021.

{{cite news}}: CS1 maint: multiple names: authors list (link) - 1 2 ""Дочерние" российские зарубежные банки и сеть ВТБ: доли ЦБ, ВТБ и др" [Russian Foreign "Daughter" Banks and the VTB Network: stakes held by Central Bank, VTB, others]. compromat.ru. February 2005. Retrieved 15 July 2021.

- 1 2 Бирман, Александр (Birman, Alexander) (21 February 2005). "В советских сетях: Нефтедоллары пойдут по проверенным каналам загранбанков" [In Soviet networks: Oil dollars will go through proven channels of foreign banks]. Компании Деловой Еженедельник (ko.ru). Archived from the original on 13 March 2005. Retrieved 15 July 2021.

{{cite news}}: CS1 maint: multiple names: authors list (link) - ↑ Рубин, Михаил (Rubin, Mikhail); Баданин, Роман (Badanin, Roman) (28 November 2018). "Телега из Кремля. Рассказ о том, как власти превратили Telegram в телевизор" [A cart from the Kremlin. The story of how the authorities turned Telegram into a TV]. Проект (proekt.media) (in Russian). Retrieved 15 July 2021.

{{cite news}}: CS1 maint: multiple names: authors list (link) - ↑ Jason Bush, Lidia Kelly and Alexander Winning (30 January 2015). "Russian central bank makes surprise interest rate cut". Reuters. Archived from the original on 30 January 2015. Retrieved 31 January 2015.

- ↑ "Fact Sheet: United States Imposes First Tranche of Swift and Severe Costs on Russia". The White House. 22 February 2022. Retrieved 23 February 2022.

- ↑ "IMF approves $1.4 billion Ukraine aid and BIS suspends Russia". Central Banking. 10 March 2022.

- ↑ Lomax, Securities Finance Times reporter Jenna (2 March 2022). "DTCC blocks Russian securities from Bank of Russia". www.securitiesfinancetimes.com.

- ↑ Cohen, Patricia; Nelson, Eshe; Safronova, Valeriya; Levenson, Michael (26 May 2022). "As Russia Diverges From the Global Economy, Soviet-Style Scarcity Looms". The New York Times. ISSN 0362-4331. Retrieved 27 May 2022.

- ↑ Kirschenbaum, J. (16 May 2022). "Now is not the time to confiscate Russia's central bank reserves". Bruegel.

- ↑ Davidson, Kate; Weaver, Aubree Eliza (28 February 2022). "The West declares economic war on Russia". Politico. Archived from the original on 1 March 2022.

- ↑ Pop, Valentina (25 February 2022). "EU leaders agree more Russia sanctions, but save some for later". Financial Times. Archived from the original on 26 February 2022.

- ↑ "Germany open to Russian Central Bank asset seizure to finance Ukraine's recovery". Euractiv. 17 May 2022.

Further reading

- Barenboim, Peter (2001). "Constitutional Economics and the Bank of Russia". Fordham Journal of Corporate and Financial Law. 7 (1): 160.

External links

- Bank of Russia (in Russian and English)

- (in Russian) Creation of the State Bank of the Russian Empire

- (in Russian) State Bank of the Russian Empire at the site of the Central Bank of the Russian Federation

- (in English) State Bank of the Russian Empire at the site of the Central Bank of the Russian Federation