罗宾汉效应

罗宾汉效应的成因

许多政策或经济决策可引起罗宾汉效应,但并不是所有决策都是为了缩减贫富差距。本文仅列出其中部分。

国家自身发展

库兹涅茨曲线

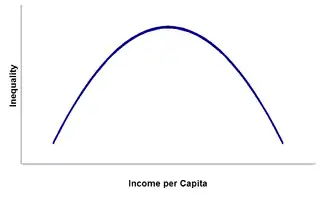

西蒙·史密斯·库兹涅茨认为,国家经济发展的阶段是决定贫富差距程度的一个主要因素。库兹涅茨描述了收入等级和贫富差距之间的一种近似曲线的关系,如图所示。此理论认为,发展程度极低的国家中,财富的分配会相对平等。

国家的资本必定随着国家的发展增加,资本的所有者也随之拥有更多财富和收入,进而引入贫富差距。然而,诸多的再分配机制最终会导致罗宾汉效应,将财富再分配给穷人,例如涓滴效应和社会福利项目。因此,发展程度更高的国家中,贫富差距又会缩小。

实例

参考

- Webster (页面存档备份,存于) (4b): increasing in rate as the base increases (a progressive tax)

- American Heritage 的存檔,存档日期2009-02-09. (6). Increasing in rate as the taxable amount increases.

- Britannica Concise Encyclopedia (页面存档备份,存于): Tax levied at a rate that increases as the quantity subject to taxation increases.

- Princeton University WordNet (页面存档备份,存于): (n) progressive tax (any tax in which the rate increases as the amount subject to taxation increases)

- Sommerfeld, Ray M., Silvia A. Madeo, Kenneth E. Anderson, Betty R. Jackson (1992), Concepts of Taxation, Dryden Press: Fort Worth, TX

- Hyman, David M. (1990) Public Finance: A Contemporary Application of Theory to Policy, 3rd, Dryden Press: Chicago, IL

- James, Simon (1998) A Dictionary of Taxation, Edgar Elgar Publishing Limited: Northampton, MA

This article is issued from Wikipedia. The text is licensed under Creative Commons - Attribution - Sharealike. Additional terms may apply for the media files.