.svg.png.webp) | |

Headquarters at UOB Plaza | |

| Type | Public |

|---|---|

| SGX: U11 | |

| Industry | Financial services |

| Founded | 6 August 1935 |

| Founder | Chew Teck Weng |

| Headquarters | UOB Plaza, , Singapore 048624 |

Area served | Southeast Asia, China |

Key people |

|

| Revenue | S$8.061 billion (2016)[1] |

| S$3.096 billion (2016)[1] | |

| Total assets | US$334.09 billion (2021)[2] |

Number of employees | 24,853 (2016)[1] |

| Rating | S&P: AA−[3] |

| Website | www |

United Overseas Bank Limited (simplified Chinese: 大华银行有限公司; traditional Chinese: 大華銀行有限公司; pinyin: Dàhuá Yínháng Yǒuxìan Gōngsī; Pe̍h-ōe-jī: Tāi-hôa Gûn-hâng Iú-hān Kong-si), often known as UOB, is a Singaporean multinational bank headquartered at Raffles Place, Singapore, with branches mostly found in Southeast Asia countries. It is one of the three "big local banks" in the country, the other two being DBS Bank and OCBC Bank.

First Founded in 1935 as United Chinese Bank (UCB) by a businessman named Chew Teck Weng, the bank was set up together with a group of Chinese-born businessmen at the Bonham Building, close to the Singapore River. The bank is the third largest bank in Southeast Asia by total assets.[4]

UOB provides personal financial services, commercial banking, private banking and asset management services, as well as corporate finance, venture capital and insurance services. It has 68 branches in Singapore and a network of more than 500 offices in 19 countries and territories in Asia Pacific, Western Europe and North America.[5]

History

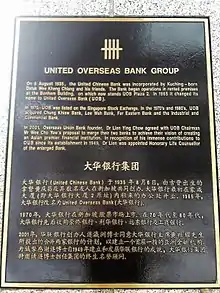

On 6 August 1935, businessman Wee Kheng Chiang, together with six other friends, established the bank after raising S$1 million. The bank was named United Chinese Bank (UCB) to emphasise its links to the Chinese population in Singapore. In October 1935, UCB opened for business in the three-story Bonham Building.[6] In 1965, the bank was renamed United Overseas Bank (Chinese name unchanged) to avoid duplication with another United Chinese Bank in Hong Kong (simplified Chinese: 中国联合银行; traditional Chinese: 中國聯合銀行), and opened its first overseas branch in Hong Kong.[7]

In 1970, UOB was listed on the Joint Stock Exchange of Singapore and Malaysia. At the time, the stock exchange had an office in both Singapore and Kuala Lumpur. After it was publicly listed, the bank went through a series of targeted acquisitions. The bank first acquired the controlling stake of Chung Khiaw Bank in 1971, which expanded its domestic presence and also gave the bank offices in Malaysia and Hong Kong. A new logo for both United Overseas Bank and Chung Khiaw Bank was launched in January 1972.[8]

In 1973, UOB then acquired Lee Wah Bank, which provided services in Malaysia and Singapore.[9] In that same year, the bank built a new 30-storey office tower in place of the Bonham Building, which was named the UOB Building (now known as UOB Plaza 2).[10] The company continued with acquisitions, with Far Eastern Bank in 1984, Westmont Bank (now known as UOB Philippines) and Radanasin Bank (now known as United Overseas Bank (Thai) Public Company Limited) in 1999. The bank then merged with the Overseas Union Bank Limited (OUB) in a deal estimated to be worth S$10 billion in 2001.

On 18 January 2019, UOB was listed in the Bloomberg Gender-Equality Index (GEI) for the first time in recognition of gender equality.[11]

In 2002, UOB started expanding into the Chinese market by opening a new full-service branch office in Shanghai and upgrading of its Beijing office to a full-service branch.[12]

Shareholders

The ten largest shareholders as of 1 March 2017[1] are:

| Name of Shareholders | No. of Shareholdings | %* | |

|---|---|---|---|

| 1. | Citibank Nominees Singapore Pte Ltd | 300,184,672 | 18.35 |

| 2. | DBS Nominees (Private) Limited | 278,681,033 | 17.04 |

| 3. | DBSN Services Pte. Ltd. | 141,007,324 | 8.62 |

| 4. | United Overseas Bank Nominees (Private) Limited | 134,666,910 | 8.23 |

| 5. | Wee Investments Pte Ltd | 128,119,445 | 7.83 |

| 6. | Wah Hin & Co Pte Ltd | 83,858,671 | 5.13 |

| 7. | HSBC Singapore (Nominees) Pte Ltd | 82,830,186 | 5.06 |

| 8. | Tai Tak Estates Sendirian Berhad | 68,168,000 | 4.17 |

| 9. | UOB Kay Hian Private Limited | 41,198,717 | 2.52 |

| 10 | C Y Wee & Co Pte Ltd | 36,319,299 | 2.22 |

* Percentage is calculated based on the total number of issued ordinary shares, excluding treasury shares.

International operations

UOB has branches and offices located across Asia Pacific, North America and Western Europe, with most of their operations located in Southeast Asian countries such as Brunei, Malaysia, Indonesia, Myanmar, Philippines, Thailand and Vietnam.

Australia

Headquartered in the UOB Building in Sydney, UOB Australia opened its first branch in MLC Centre as a merchant bank in 1986 to emphasize on trade and financing between Australia and Asia.[13] The bank now has offices in Melbourne and Brisbane, in addition to the branch in Sydney and currently offers merchant bank services comprising current accounts, deposits, lending, asset finance, trade finance, structured finance, cash management, and cross-border payments.[14]

Brunei

UOB's operations in Brunei started in 1974, under Overseas Union Bank (OUB). When UOB acquired the Overseas Union Bank in January 2002, the operations of the branches in Brunei was handed over to UOB. On 1 October 2005, the bank relocated its branch office in Bandar Seri Begawan.[15]

In 2015, UOB sold its retail banking business to Baiduri Bank Berhad for S$65.044 million. The bank currently provides a full range of commercial and corporate banking services through the branch located in the country. It also operates UOB Asset Management in Brunei, which offers investment management expertise to individuals, institutions and corporations.[16]

China

Operations in mainland China first started in 1984, with a representative office in Beijing. Incorporated on 18 December 2007 as UOB (China) and headquartered in Shanghai, UOB has 17 branches and sub-branches strategically located in major cities such as Shenyang, Shanghai, Beijing, Shenzhen, Tianjin, Xiamen, Hangzhou, Chengdu, Guangzhou, Suzhou and Chongqing offering retail and wholesale banking services.[17]

Hong Kong

UOB opened its first overseas branch in British Hong Kong in 1965, with the branch mainly focusing on trade financing and corporate banking.[18] In the past, 2 of the Hong Kong branches were under the subsidiary Chung Khiaw Bank.

The bank currently has 3 branches offering commercial and corporate banking services.[19]

India

In December 2009, UOB opened its first branch in Mumbai, offering retail and wholesale banking services, including lending, treasury and trade finance products, to corporates, financial institutions and consumers.[20]

Indonesia

UOB Indonesia was founded on 31 August 1956 as PT Bank Buana Indonesia. Headquartered in Jakarta, the bank offers commercial banking and treasury services, such as deposits taking, loans to small and medium enterprises, and foreign exchange transactions. The company also offers various fee-based services, such as purchase and sale of travellers cheques and banknotes.[21] It has a network of 41 branches, 172 sub-branches and 173 ATMs located across 30 cities in Indonesia.[22]

Japan

Founded in December 1972, UOB Japan offers wholesale services including corporate banking, debt securities investments, treasury, trade finance, current accounts and banknotes trading. UOB has 1 branch in Tokyo. Operations of OUB in Tokyo was also integrated in 2002 when UOB acquired the bank in 2002.[23]

Malaysia

Incorporated in 1993, UOB Malaysia was integrated with Lee Wah Bank in 1994 to operate as a single entity. Lee Wah Bank was founded in 1920 in Singapore, with its first Malaysian branch opened in 1956. In 1973, Lee Wah Bank became a wholly owned subsidiary of UOB and was merged with UOB Malaysia in 1994. In 1997, UOB Malaysia merged with Chung Khiaw Bank (Malaysia) before merging with OUB Malaysia in 2002 to centralise its operations in Malaysia.[24]

The bank offers commercial and personal financial services: deposits, unit trusts, UOB Bancassurance, privilege banking, e-banking, commercial lending, investment banking, treasury services, trade services, home loans, debit and credit cards, wealth management, structured investment, general insurance and life insurance.[25]

Myanmar

Philippines

In November 1999, UOB bought a 60% stake in a local bank, Westmont Bank and the bank was renamed UOB Philippines. In July 2002, UOB increased it stake to 100%, resulting in UOB Philippines becoming a wholly owned subsidiary of the banking group.[27] In 2006, UOB Philippines's 66 bank branches were sold to Banco De Oro Universal Bank and the bank ceased to be a commercial bank, with its license converted into a thrift bank license.

In August 2015, Bangko Sentral ng Pilipinas, the central bank of the Philippines, approved the bank's application for a commercial bank license,[28] and in the following year UOB Philippines opened its first commercial branch in Manila, being the 6th foreign bank in the Philippines to receive the license.[29]

South Korea

In 1983, UOB opened its first representative office in Seoul[30] and in 1998, the bank has a total of S$81 million assets in South Korea.[31] The bank currently operates a branch in Seoul.

Thailand

UOB merged Radanasin Bank with Bank of Asia in 2005[32] with 154 branches across Thailand.

Vietnam

UOB obtained the FOSB licence to grow in Vietnam in 1993. UOB announces completion of the acquisition of the retail banking segment, including the transfer of 575 CitiBank employees in Vietnam in March 2023.[33]

United States

UOB is represented in the US by two agencies located in Los Angeles and New York. Both agencies provide services such as syndicated loan participations, corporate/commercial loans, asset swaps and deposits.

Canada

United Overseas Bank (Canada) was originally established in 1986 as a Schedule II wholly-owned subsidiary of United Overseas Bank Limited, in Singapore. In 2002, United Overseas Bank (Canada) was converted to a Full Service Foreign Bank Branch (Schedule III), operating under the name United Overseas Bank Limited, in Vancouver, British Columbia.

United Kingdom

UOB established a presence in the United Kingdom in 1975 in London. The UOB London Branch provides wholesale banking services including loans, deposits, trade finance, treasury and general account services.

Subsidiaries and joint ventures

All subsidiaries are headquartered in UOB Plaza, Singapore

- Subsidiaries

- Far Eastern Bank Limited

- UOB Bullion and Futures Limited

- UOBBF Clearing Limited

- United Overseas Insurance Limited

- UOB Asia Investment Partners Pte. Ltd.

- UOB Asset Management Ltd

- UOB-SM Asset Management Pte. Ltd.

- UOB Venture Management Private Limited

- Joint ventures

- United Orient Capital Pte. Ltd

- Associates

Digital banking

On 14 February 2019, UOB announced that it will launch TMRW (the first mobile-only bank) with Thailand the first country to get this service. More ASEAN countries will get this service in the coming months, in a push to cater to millennials who mainly use mobile phones for banking. UOB aims to attract three to five million users for this service in the next five years. The service launched in March that year.[34]

On 3 August 2020, UOB launched TMRW in Indonesia after alluding to it earlier on 21 February.[35][36] Subsequently on 28 September 2021, UOB announced a $500 million boost in digital banking investments over the next five years to double its digital customers to seven million by 2026 and expand digital offerings in Singapore and ASEAN. This will include combining UOB Mighty app with the TMRW app to form the UOB TMRW app, which will be launched in Singapore by the fourth quarter of 2021. The app was first given to UOB employees as a pilot. In addition, digital banking services will be unified in countries like Malaysia and Vietnam.[37][38]

Controversies

1Malaysia Development Berhad scandal

In May 2017, the Monetary Authority of Singapore (MAS) fined UOB a total of S$900,000 for several breaches of anti-money laundering rules and control lapses in transactions related to Malaysia’s scandal-ridden sovereign wealth fund 1Malaysia Development Berhad (1MDB). These include weaknesses in conducting due diligence on customers and inadequate scrutiny of customers’ transactions and activities.[39]

RBI fine due to compliance lapses

On 1 October 2019, UOB was fined INR ₹10 million by the Reserve Bank of India (RBI) for compliance failures based on deficiencies in regulatory compliance.[40][41]

Money laundering and business conduct compliance failures fine

On 31 August 2022, the stockbroking arm of UOB – UOB Kay Hian Private Limited which is an associate company of UOB, was fined S$375,000 for failing to comply with business conduct requirements under the Securities and Futures (Licensing and Conduct of Business) Regulations, as well as anti-money laundering and countering the financing of terrorism requirements listed by the Monetary Authority of Singapore (MAS).[42]

See also

References

- 1 2 3 4 "UOB Annual Report 2016" (PDF). Archived from the original (PDF) on 27 January 2018. Retrieved 6 July 2017.

- ↑ "The World's Biggest Public Companies". Forbes.

- ↑ "DBS, OCBC, UOB get AA- credit rating from S&P". The Straits Times. Retrieved 26 March 2017.

- ↑ "ForbesG2000". Forbes. Retrieved 5 July 2015.

- ↑ "UOB Bank Branches". BanksinSG.COM. 30 October 2019. Retrieved 17 April 2020.

- ↑ "United Overseas Bank Archived 2010-10-12 at the Wayback Machine Heritage Trails Singapore. Retrieved August 31, 2012.

- ↑ Lim, Richard, "A Few Good Men," Straits Times, 12 August 2002. Retrieved 15 November 2015

- ↑ "大華銀行崇僑銀行舉行酒會慶祝聯用新標誌". Nanyang Siang Pau (in Chinese). Singapore. 3 January 1972. Retrieved 11 October 2017 – via Singapore National Library.

- ↑ SMART-TOWKAY.COM. "The History of Banking in Singapore". SMART-TOWKAY Pte. Ltd. Retrieved 6 June 2023.

- ↑ "It's Always the Next Deal," South China Morning Post, 13 May 2002. Retrieved 15 November 2015

- ↑ Seow, Joanna (19 January 2019). "Four local firms lauded for furthering women's equality". The Straits Times. Retrieved 23 July 2020.

- ↑ Montlake, Simon, "Singapore Bankers Take the Plunge," Banker, August 2002, p. 45. Retrieved 15 November 2015

- ↑ "UOB chairman opens Sydney merchant bank today". The Business Times, 29 July 1986, Page 6. 1986. Retrieved 16 November 2015.

- ↑ "Company Overview of UOB Australia Limited". Bloomberg.

- ↑ "Brunei Office Re-locates To Serve You Better" (PDF). UOB Group. October 2005. Retrieved 16 November 2015.

- ↑ "Singapore: UOB sells Brunei retail banking business to Baiduri Bank for $46.6m". Deal Street Asia. October 2015.

- ↑ "About UOB China". UOB.

- ↑ Lee, 2003, p. 162; Tai, 2010, pp. 471–472; Steady growth hallmark of the UOB story. (20 October 2003). The Business Times, p. 3. Retrieved from NewspaperSG.

- ↑ "UOB Hong Kong | Branch Locations". www.uobgroup.com. Retrieved 21 August 2022.

- ↑ "UOB's new country head for India to prioritise local corporates' expansion in SEAsia" (PDF). Asian Banking and Finance. Retrieved 25 March 2017.

- ↑ "Company Overview of PT. Bank UOB Indonesia, Tbk". Bloomberg. Retrieved 24 March 2017.

- ↑ "Bank Uob Indonesia Pt Company Profile". EMIS. Retrieved 24 March 2017.

- ↑ "About UOB Tokyo". UOB Group. Retrieved 24 March 2017.

- ↑ "United Overseas Bank (M) Berhad (UOB)". Lawyerment. Retrieved 24 March 2017.

- ↑ "United Overseas Bank (Malaysia) Bhd.: Private Company Information – Bloomberg". Bloomberg News. Retrieved 24 March 2017.

- ↑ "UOB Myanmar | Yangon". www.uobgroup.com. Retrieved 21 August 2017.

- ↑ "UOB Philippines : About Us". UOB Philippines. Retrieved 15 April 2020.

- ↑ "UOB to operate as commercial bank in Philippines". Philstar.com. 20 September 2015. Retrieved 15 April 2020.

- ↑ "Singapore's UOB opens Manila branch". Philstar.com. 21 January 2016. Retrieved 5 April 2020.

- ↑ "UOB office in Seoul". BUSINESS TIMES (Archived on NewspaperSG). 6 August 1983. Retrieved 15 April 2020.

- ↑ "Annual Report 1997, UOB" (PDF). UOB Group. 1998. Retrieved 15 April 2020.

- ↑ Newswires, Pang Ai Lin and Rattaphol OnsanitDow Jones (12 May 2004). "Singapore Lender to Buy Stake in Bank of Asia". Wall Street Journal. ISSN 0099-9660. Retrieved 2 November 2021.

- ↑ "UOB Vietnam". 11 July 2023. Retrieved 11 July 2023.

- ↑ "UOB to launch its digital bank first in Thailand". The Straits Times. 14 February 2019. Retrieved 29 September 2019.

- ↑ "UOB launches digital bank TMRW in Indonesia". The Straits Times. 3 August 2020. Retrieved 16 January 2022.

- ↑ Aw, Cheng Wei (21 February 2020). "UOB to expand digital bank TMRW to Indonesia this year; Q4 net profit up 10% to $1.01b". The Straits Times. Retrieved 16 January 2022.

- ↑ "UOB to invest $500m to ramp up digital capabilities across ASEAN as it aims to more than double its digital retail customers by 2026". UOB. 29 September 2021. Retrieved 16 January 2022.

- ↑ Kang, Wan Chern (29 September 2021). "UOB to invest $500 million to boost digital bank presence in Singapore, Asean". The Straits Times. Retrieved 16 January 2022.

- ↑ "Singapore fines Credit Suisse, UOB over 1MDB-linked dealings, wraps up review". Reuters. Retrieved 30 May 2017.

- ↑ "Reserve Bank of India imposes penalty on United Overseas Bank Limited". Reserve Bank of India. Retrieved 3 October 2019.

- ↑ "United Overseas Bank fined by India regulator for compliance lapse". Retail Banker International. Retrieved 4 October 2019.

- ↑ "UOB Kay Hian fined S$375,000 for business conduct compliance failures". The Business Times. Retrieved 1 September 2022.