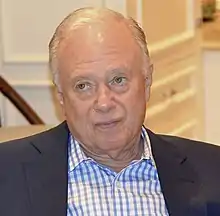

John Vogelstein | |

|---|---|

| |

| Born | December 9, 1934 New York City, US |

| Nationality | American |

| Occupation(s) | President, Vice-chairman Warburg Pincus |

| Spouse | Barbara Louise Manfrey |

| Children | Fred and Andrew |

John Vogelstein (born December 9, 1934) is an American businessman who, with Lionel Pincus, established the "venture capital megafund" in the 1960s, while running the private equity firm Warburg Pincus.[1][2] He joined Pincus and the firm from Lazard Freres in 1967.[3][4] Pincus was the founder and chairman[5] while Vogelstein was vice chairman[6] and then president.[7][1] During his time at Warburg Pincus, the company became the financial industry’s first $100 million fund in 1981, and the first $1 billion fund in 1986.[8][1] He and Pincus went on to raise billions of dollars to invest in companies across diversified industries.[9] He ran the company with Pincus until 2002, when they both stepped down.[10][4]

Early life and education

Vogelstein was born in New York City. His parents were Ruth and Hans Vogelstein.[11] He was a student at the Taft School in Watertown, Connecticut.[12] Vogelstein then attended Harvard College for two years before leaving at age nineteen to begin his career in finance at Lazard.[13][14]

Career

Vogelstein was at Lazard for 13 years, rising to become its head of research and then partner in early 1964,[15] when he was 29.[13][14] After a disagreement with senior partner Andre Meyer in 1967, he joined Lionel Pincus in founding the specialized financial services firm that would become Warburg Pincus,[13][4] Vogelstein and Pincus developed the strategy of very large, long-term and diversified investments.[2][8] As executive vice president, Vogelstein led the company’s negotiations in deals that included Twentieth Century Fox, Humana and Mattel.[8][16] He was a member of the board of Twentieth Century Fox in the late 1970s, and elected to the board of production company Filmways after it was acquired by Orion Pictures in 1982.[17][18] Vogelstein is credited for engineering Warburg Pincus’s 1984 financial rescue of toy company Mattel in which $231 million was invested.[2][19][20] As the largest shareholder in Mattel, Warburg Pincus managed the toy maker’s recovery and quadrupled its 45% investment in seven years.[21][22] Vogelstein and Pincus also negotiated the $1 billion rescue plan of Mellon Bank in 1988, using the “good bank-bad bank” structure wherein Mellon created a new bank to house troubled loans.[23][21]

He was the company’s president and vice chairman until 2002.[10][4] He became a senior adviser for Warburg Pincus starting in 2002[16] and remained a special limited partner of the firm.[24] As of 2013, Vogelstein led the investment firm New Providence Asset Management, as chairman and general partner.[25][14]

Personal life

Vogelstein married Barbara Louise Manfrey in 2000. His previous marriages ended in divorce.[11] He has two sons, Fred and Andrew.[26] Vogelstein served as the chairman of the Taft School,[11] Third Way,[25] and chairman emeritus of the New York City Ballet[24] and Prep for Prep.[27]

References

- 1 2 3 Janeway, D. W. H. (8 October 2012). Doing Capitalism in the Innovation Economy: Markets, Speculation and the State. Cambridge University Press. p. 91. ISBN 9781139789905.

- 1 2 3 Gupta, Udayan (3 March 1987). "Megafund Chief Pincus Speaks Softly, Carries a $1.17 Billion Venture Stake". The Wall Street Journal.

- ↑ Fabrikant, Geraldine (11 October 2009). "Lionel Pincus, Who Helped Bring Investors to Private Equity, Dies at 78". The New York Times. Retrieved 3 October 2020.

- 1 2 3 4 Berman, Phyllis (8 May 2006). "We'll Do It Our Way". Forbes. Retrieved 2 October 2020.

- ↑ "Lionel Pincus, 78, founder, chairman of Warburg Pincus". Boston Globe. Associated Press. 13 October 2009. Retrieved 3 October 2020.

- ↑ Lattman, Peter; Miller, Stephen (13 October 2009). "Wall Street Leader Helped Shape Private-Equity Arena". The Wall Street Journal. Retrieved 3 October 2020.

- ↑ Harmetz, Aljean (10 February 1983). "Orion Group Gets Filmways". The New York Times. Retrieved 3 October 2020.

- 1 2 3 Fisher, Daniel (4 September 2013). "Warburg Pincus: The Merchant Of Modest". Forbes. Retrieved 2 October 2020.

- ↑ Rehfeld, Barry (23 October 1994). "Profile; Even in Hard Times, He's Still the Top Player in Town". The New York Times. Retrieved 1 October 2020.

- 1 2 Scannell, Kara; Sender, Henny (29 April 2002). "Fund's Completion Marks Milestone For Warburg Pincus's New Leaders". The Wall Street Journal. Retrieved 2 October 2020.

- 1 2 3 "WEDDINGS; Barbara Manfrey, John Vogelstein". The New York Times. 23 April 2000. Retrieved 1 October 2020.

- ↑ "John L. Vogelstein". Third Way. Retrieved 2 October 2020.

- 1 2 3 Reich, C.; Meyer, A. (1983). Financier: The Biography of Andre Meyer: A Story of Money, Power, and the Reshaping of American Business. Morrow. ISBN 9780688015510.

- 1 2 3 "John L. Vogelstein". Bloomberg. Retrieved 2 October 2020.

- ↑ "Lazard Freres Names New Partner". New York Times. 10 February 1964. Retrieved 1 October 2020.

- 1 2 Saito-Chung, David (6 February 2013). "Lionel Pincus Ignited Venture Capital's Boom Invest: His private-equity moves spurred growth firms". Investor's Business Daily.

- ↑ Harmetz, Aljean (21 September 1979). "Hirschfield in Talks with Fox". New York Times. Retrieved 1 October 2020.

- ↑ Harmetz, Aljean (10 February 1982). "Orion Group Gets Filmways". The New York Times. Retrieved 1 October 2020.

- ↑ Bannon, Lisa; Lublin, Joann S. (4 February 2000). "Jill Barad Resigns as Mattel CEO As Toymaker's Results Suffer". The Wall Street Journal. Retrieved 1 October 2020.

- ↑ Berman, Phyllis (12 August 1985). "Destiny's Plaything". Forbes.

- 1 2 Anders, George (19 July 1990). "Is Warburg Pincus's Magic Waning?". The Wall Street Journal.

- ↑ Gellene, Denise (3 July 1989). "Mattel Isn't Toying Around : Firm Manages Dramatic Comeback From Near-Disaster". LA Times. Retrieved 1 October 2020.

- ↑ Fitzpatrick, Dan (8 April 2008). "The Return of 'Good Bank-Bad Bank'". The Wall Street Journal. Retrieved 22 October 2020.

- 1 2 Bandell, Brian (2 March 2018). "Disbarred attorney sells South Beach condo for $15M". South Florida Business Journal. Retrieved 19 March 2021.

- 1 2 Bierman, Noah (6 Oct 2014). "Third Way in struggle for the Democratic Party's soul". Boston Globe.

- ↑ Beyus, Linda. "The Dedication". No. Fall 2002. Taft Bulletin. Retrieved 2 October 2020.

- ↑ "Board of Trustees". www.prepforprep.org. Retrieved 2023-02-24.