Infrastructure as an asset class

Although traditionally the preserve of governments and municipal authorities, infrastructure has recently become an asset class in its own right for private-sector investors, most notably pension funds.[1][2]

Historically, pension funds have tended to invest mostly in "core assets" (such as money market instruments, government bonds, and large-cap equity) and, to a lesser extent, "alternative assets" (such as real estate, private equity and hedge funds).[3] The average allocation to infrastructure historically represented only 1% of total assets under management by pensions, excluding indirect investment through ownership of stocks of listed utility and infrastructure companies.

However, government disengagement from the costly long-term financial commitments required by large infrastructure projects in the wake of the 2008–2012 global recession,[4] combined with the realization that infrastructure could be an ideal asset class providing advantages such as long duration, facilitating cash flow matching with long-term liabilities, protection against inflation, and statistical diversification (i.e., a low correlation with "traditional" listed assets such as equities and fixed income), has prompted an increasing number of pension executives to consider investing in the infrastructure asset class. This macro-financial perspective on pension investment in infrastructure was developed by US, Canadian, and European financial economics and labor law experts, notably from Harvard Law School, the World Pensions Council, and the OECD.[5]

"At the start of the decade, the World Pensions Council (WPC) and the Organisation for Economic Co-operation and Development (OECD) helped convene some of the first international summits focusing on the future of long-term investments in the post-Lehman era, arguing that infrastructure would soon become an asset class in its own right. At that time, we thought that the crisis would usher an era of durably low interest rates, pushing more pension and insurance investors to pursue a ‘quest for yields,’ increasing mechanically their allocation to non-traditional asset classes such as private equity, real estate and [listed and non-listed] infrastructure."[6]

Canadian, Californian, and Australian early entrants

Pension funds, including superannuation schemes, account for approximately 40% of all investors in the infrastructure asset class, excluding projects directly funded and developed by governments, municipalities, and public authorities. Large Canadian pension funds and sovereign investors have been particularly active in energy assets such as natural gas and natural gas infrastructure, where they have become major players in recent years.[7]

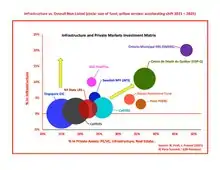

Until recently, apart from sophisticated jurisdictions such as Ontario, Quebec, California, and the Netherlands, most North American, European, and UK pensions wishing to gain exposure to infrastructure assets did so indirectly, through investments made in infrastructure funds managed by specialized Canadian, US, or Australian funds.[8][9]

UK Pensions Infrastructure Platform

On November 29, 2011, the British government unveiled an unprecedented plan to encourage large-scale pension investments in roads, hospitals, airports, and the like across the UK. The plan was aimed at enticing £20 billion ($30.97 billion) of investment in domestic infrastructure projects over a next decade. On October 18, 2012, HM Treasury announced that the National Association of Pension Funds (NAPF) and the Pension Protection Fund (PPF) had succeeded in "securing a critical mass of Founding Investors needed to move to the next stage of development" and that "several major UK pension funds have signed up to the Pension Infrastructure Platform (PIP). The intention is that the Founding Investors will provide around half of the target £2 billion of investment capital for the fund, before it launches early next year".[10]

"Infrastructure nationalism"

Some experts have warned against the risk of "infrastructure nationalism", insisting that steady investment flows from foreign pension and sovereign funds were key to the long-term success of the infrastructure asset class, notably in large European jurisdictions such as France and the UK.[11]

References

- ↑ "ABOUT US - Infrastructure Investor". 2011-07-02. Archived from the original on 2 July 2011. Retrieved 2022-05-17.

- ↑ Iain Jones (Nov 2, 2011). preqin.com/blog/101/4403/infrastructure-asset-class "Infrastructure: An Asset Class in its Own Right". Preqin Alternative Assets. Retrieved Jan 26, 2013.

{{cite news}}: Check|url=value (help) - ↑ George Inderst (Jan 2009). "Pension Fund Investment in Infrastructure" (PDF). OECD Working Paper on Insurance and Private Pensions, volume 32. Retrieved Nov 17, 2012.

- ↑ M. Nicolas Firzli (October 2011). "Infrastructure Investments in an Age of Austerity : The Pension and Sovereign Funds Perspective". Revue Analyse Financière, volume 41, pp. 34-37. Retrieved 1 October 2011.

- ↑ WPC Conference Committee (9 February 2012). "Infrastructure As A New Asset Class for Pensions and SWFs" (PDF). 2nd Annual World Pensions Forum, Roundtable led by Arbejdsmarkedets TillægsPension (ATP), Denmark’s National Supplementary Pension. Retrieved 17 August 2017.

- ↑ Firzli, M. Nicolas J. (24 May 2016). "Pension Investment in infrastructure Debt: A New Source of Capital for Project Finance". World Bank (Infrastructure and PPPs Blog). Washington, DC. Retrieved 9 August 2017.

- ↑ M. Nicolas Firzli & Vincent Bazi (July 2012). "The Drivers of Pension & SWF Investment in Energy- Focusing on Natural Gas" (PDF). Revue Analyse Financière, volume 44, pp. 41-43. Archived from the original (PDF) on 17 January 2013. Retrieved 1 July 2012.

- ↑ Mark Cobley (20 February 2012). "Infrastructure Funds Fail to Bridge the Gap" (PDF). Dow Jones Financial News. Archived from the original (PDF) on 25 May 2013. Retrieved 17 November 2012.

- ↑ Sinead Cruise and Myles Neligan (November 28, 2011). "British Infrastructure Finance Plan No Silver Bullet". Reuters. . Retrieved 28 November 2011.

- ↑ HM Treasury Newsroom and Speeches (18 Oct 2012). "Government welcomes first injection into Pensions Infrastructure Platform". HM Treasury Newsroom and Speeches. Retrieved Nov 17, 2012.

- ↑ Mark Cobley (7 Nov 2013). "Investors Warn against 'Infrastructure Nationalism'". Financial News. Retrieved Dec 12, 2013.