In psychology, economics and philosophy, preference is a technical term usually used in relation to choosing between alternatives. For example, someone prefers A over B if they would rather choose A than B. Preferences are central to decision theory because of this relation to behavior. Some methods such as Ordinal Priority Approach use preference relation for decision-making. As connative states, they are closely related to desires. The difference between the two is that desires are directed at one object while preferences concern a comparison between two alternatives, of which one is preferred to the other.

In insolvency, the term is used to determine which outstanding obligation the insolvent party has to settle first.

Psychology

In psychology, preferences refer to an individual's attitude towards a set of objects, typically reflected in an explicit decision-making process (Lichtenstein & Slovic, 2006). The term is also used to mean evaluative judgment in the sense of liking or disliking an object (e.g., Scherer, 2005) which is the most typical definition employed in psychology. However, it does not mean that a preference is necessarily stable over time. Preference can be notably modified by decision-making processes, such as choices (Brehm, 1956; Sharot, De Martino, & Dolan, 2009), even unconsciously (see Coppin, Delplanque, Cayeux, Porcherot, & Sander, 2010). Consequently, preference can be affected by a person's surroundings and upbringing in terms of geographical location, cultural background, religious beliefs, and education. These factors are found to affect preference as repeated exposure to a certain idea or concept correlates with a positive preference.[1]

Economics

In economics and other social sciences, preference refers to the set of assumptions related to ordering some alternatives, based on the degree of happiness, satisfaction, gratification, morality, enjoyment, or utility they provide. The concept of preferences is used in post-World War II neoclassical economics to provide observable evidence in relation to people's actions.[2] These actions can be described by Rational Choice Theory, where individuals make decisions based on rational preferences which are aligned with their self-interests in order to achieve an optimal outcome.[3]

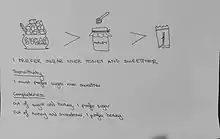

Consumer preference, or consumers' preference for particular brands over identical products and services, is an important notion in the psychological influence of consumption. Consumer preferences have three properties: completeness, transitivity and non-satiation. For a preference to be rational, it must satisfy the axioms of transitivity and Completeness (statistics). The first axiom of transitivity refers to consistency between preferences, such that if x is preferred to y and y is preferred to z, then x has to be preferred to z.[4][5] The second axiom of completeness describes that a relationship must exist between two options, such that x must be preferred to y or y must be preferred to x, or is indifferent between them.[4][5] For example, if I prefer sugar to honey and honey to sweetener then I must prefer sugar to sweetener to satisfy transitivity and I must have a preference between the items to satisfy completeness. Under the axiom of completeness, an individual cannot lack a preference between any two options.[6]

If preferences are both transitive and complete, the relationship between preference can be described by a utility function.[7] This is because the axioms allow for preferences to be ordered into one equivalent ordering with no preference cycles.[8] Maximising utility does not imply maximise happiness, rather it is an optimisation of the available options based on an individual's preferences.[9] The so-called Expected Utility Theory (EUT), which was introduced by John von Neumann and Oskar Morgenstern in 1944, explains that so long as an agent's preferences over risky options follow a set of axioms, then he is maximizing the expected value of a utility function.[10] In utility theory, preference relates to decision makers' attitudes towards rewards and hazards. The specific varieties are classified into three categories: 1) risk-averse, that is, equal gains and losses, with investors participating when the loss probability is less than 50%; 2) the risk-taking kind, which is the polar opposite of type 1); 3) Relatively risk-neutral, in the sense that the introduction of risk has no clear association with the decision maker's choice.[11]

The mathematical foundations of most common types of preferences — that are representable by quadratic or additive functions — laid down by Gérard Debreu[12][13] enabled Andranik Tangian to develop methods for their elicitation. In particular, additive and quadratic preference functions in variables can be constructed from interviews, where questions are aimed at tracing totally 2D-indifference curves in coordinate planes without referring to cardinal utility estimates.[14][15]

Empirical evidence has shown that the usage of rational preferences (and Rational Choice Theory) does not always accurately predict human behaviour because it makes unrealistic assumptions.[16][17][18] In response to this, neoclassical economists argue that it provides a normative model for people to adjust and optimise their actions.[19] Behavioural economics describes an alternative approach to predicting human behaviour by using psychological theory which explores deviations from rational preferences and the standard economic model.[20] It also recognises that rational preferences and choices are limited by heuristics and biases. Heuristics are rules of thumb such as elimination by aspects which are used to make decisions rather than maximising the utility function.[21] Economic biases such as reference points and loss aversion also violate the assumption of rational preferences by causing individuals to act irrationally.[22]

Individual preferences can be represented as an indifference curve given the underlying assumptions. Indifference curves graphically depict all product combinations that yield the same amount of usefulness. Indifference curves allow us to graphically define and rank all possible combinations of two commodities.[23]

The graph's three main points are:

1. If more is better, the indifference curve dips downward.

2. Greater transitivity indicates that the indifference curves do not overlap.

3. A propensity for diversity causes indifference curves to curve inward.

Risk preference

Risk preference is defined as how much risk a person is prepared to accept based on the expected utility or pleasure of the outcome.

Risk tolerance is a critical component of personal financial planning, that is, risk preference.

In psychology, risk preference is occasionally characterised as the proclivity to engage in a behaviour or activity that is advantageous but may involve some potential loss, such as substance abuse or criminal action that may bring significant bodily and mental harm to the individual.[24]

In economics, risk preference refers to a proclivity to engage in behaviours or activities that entail greater variance returns, regardless of whether they be gains or losses, and are frequently associated with monetary rewards involving lotteries.[25]

There are two different traditions of measuring preference for risk, the revealed and stated preference traditions, which Coexist in psychology, and to some extent in economics as well.[26][27][28]

Risk preference evaluated from stated preferences emerges as a concept with significant temporal stability, but revealed preference measures do not.[29]

Relation to desires

Preferences and desires are two closely related notions: they are both conative states that determine our behavior.[30] The difference between the two is that desires are directed at one object while preferences concern a comparison between two alternatives, of which one is preferred to the other.[31][30] The focus on preferences instead of desires is very common in the field of decision theory. It has been argued that desire is the more fundamental notion and that preferences are to be defined in terms of desires.[32][31][30] For this to work, desire has to be understood as involving a degree or intensity. Given this assumption, a preference can be defined as a comparison of two desires.[32] That Nadia prefers tea over coffee, for example, just means that her desire for tea is stronger than her desire for coffee. One argument for this approach is due to considerations of parsimony: a great number of preferences can be derived from a very small number of desires.[32][30] One objection to this theory is that our introspective access is much more immediate in cases of preferences than in cases of desires. So it is usually much easier for us to know which of two options we prefer than to know the degree with which we desire a particular object. This consideration has been used to suggest that maybe preference, and not desire, is the more fundamental notion.[32]

Insolvency

In Insolvency, the term can be used to describe when a company pays a specific creditor or group of creditors. From doing this, that creditor(s) is made better off, than other creditors. After paying the 'preferred creditor', the company seeks to go into formal insolvency like an administration or liquidation. There must be a desire to make the creditor better off, for them to be a preference. If the preference is proven, legal action can occur. It is a wrongful act of trading. Disqualification is a risk.[33] Preference arises within the context of the principle maintaining that one of the main objectives in the winding up of an insolvent company is to ensure the equal treatment of creditors.[34] The rules on preferences allow paying up their creditors as insolvency looms, but that it must prove that the transaction is a result of ordinary commercial considerations.[34] Also, under the English Insolvency Act 1986, if a creditor was proven to have forced the company to pay, the resulting payment would not be considered a preference since it would not constitute unfairness.[35] It is the decision to give a preference, rather than the giving of the preference pursuant to that decision, which must be influenced by the desire to produce the effect of the preference. For these purposes, therefore, the relevant time is the date of the decision, not the date of giving the preference.[36]

See also

- Motivation

- Ordinal Priority Approach

- Preference-based planning (in artificial intelligence)

- Preference revelation

- Choice

- Pairwise comparison

References

- ↑ Zajonc, Robert B.; Markus, Hazel (1982-09-01). "Affective and Cognitive Factors in Preferences". Journal of Consumer Research. 9 (2): 123–131. doi:10.1086/208905. ISSN 0093-5301.

- ↑ Allan, Bentley B. (2019). "Paradigm and nexus: neoclassical economics and the growth imperative in the World Bank, 1948-2000". Review of International Political Economy. 26 (1): 183–206. doi:10.1080/09692290.2018.1543719. S2CID 158564367.

- ↑ Zey, Mary (1998). Rational Choice Theory and Organizational Theory: A Critique. SAGE Publications, Inc. pp. 1–13.

- 1 2 Bossert, Walter; Kotaro, Suzumura (2009). "External Norms and Rationality of Choice". Economics and Philosophy. 25 (2): 139–152. doi:10.1017/S0266267109990010. S2CID 15220288.

- 1 2 Schotter, Andrew (2006). "Strong and Wrong: The Use of Rational Choice Theory in Experimental Economics". Journal of Theoretical Politics. 18 (4): 498–511. doi:10.1177/0951629806067455. S2CID 29003374.

- ↑ Eliaz, Kfir (2006). "Indifference or indecisiveness? Choice-theoretic foundations of incomplete preferences". Games and Economic Behavior. 56: 61–86. doi:10.1016/j.geb.2005.06.007.

- ↑ Aleskerov, Fuad (2007). Utility Maximization, Choice and Preferences (2 ed.). Springer. pp. 17–52.

- ↑ List, Christian (2012). "The theory of judgment aggregation: an introductory review" (PDF). Synthese. 187 (1): 179–207. doi:10.1007/s11229-011-0025-3. S2CID 6430197.

- ↑ Kirsh, Yoram (2017). "Utility and Happiness in a Prosperous Society". OUI – Institute for Policy Analysis Working Paper Series. 37.

- ↑ Teraji, Shinji (2018). The Cognitive Basis of Institutions: A Synthesis of Behavioral and Institutional Economics. London: Academic Press. p. 137. ISBN 9780128120231.

- ↑ Nagaya, Kazuhisa (2021-10-15). "Why and Under What Conditions Does Loss Aversion Emerge?". Japanese Psychological Research. 65 (4): 379–398. doi:10.1111/jpr.12385. ISSN 0021-5368. S2CID 244976714.

- ↑ Debreu, Gérard (1952). "Definite and semidefinite quadratic forms". Econometrica. 20 (2): 295–300. doi:10.2307/1907852. JSTOR 1907852.

- ↑ Debreu, Gérard (1960). "Topological methods in cardinal utility theory". In Arrow, Kenneth (ed.). Mathematical Methods in the Social Sciences,1959. Stanford: Stanford University Press. pp. 16–26. doi:10.1016/S0377-2217(03)00413-2.

- ↑ Tangian, Andranik (2002). "Constructing a quasi-concave quadratic objective function from interviewing a decision maker". European Journal of Operational Research. 141 (3): 608–640. doi:10.1016/S0377-2217(01)00185-0.

- ↑ Tangian, Andranik (2004). "A model for ordinally constructing additive objective functions". European Journal of Operational Research. 159 (2): 476–512. doi:10.1016/S0377-2217(03)00413-2.

- ↑ Kalter, Frank; Kroneberg, Clemens (2012). "Rational Choice Theory and Empirical Research: Methodological and Theoretical Contributions in Europe". Annual Review of Sociology. 38 (1): 73–92. doi:10.1146/annurev-soc-071811-145441.

- ↑ England, Paula (1989). "A feminist critique of rational-choice theories: Implications for sociology". The American Sociologist. 20 (1): 14–28. doi:10.1007/BF02697784. S2CID 143743641.

- ↑ Herfeld, Catherine (2021). "Revisiting the criticisms of rational choice theories". Philosophy Compass. 17 (1).

- ↑ Case, Karl (2008). "A Response to Guerrien and Benicourt". The Review of Radical Political Economics. 40 (3): 331–335. doi:10.1177/0486613408320324. S2CID 154665809.

- ↑ Angner, Erik (2021). A Course in Behavioural Economics (3 ed.). United Kingdom: Macmillan Education Limited. pp. 25–37. ISBN 978-1-352-01080-0.

- ↑ Grandori, Anna (2010). "A rational heuristic model of economic decision making". Rationality and Society. 22 (4): 477–504. doi:10.1177/1043463110383972. S2CID 146886098.

- ↑ Bouteska, Ahmed; Regaieg, Boutheina (2020). "Loss aversion, overconfidence of investors and their impact on market performance evidence from the US stock markets". Journal of Economics, Finance and Administrative Science. 25 (50): 451–478. doi:10.1108/JEFAS-07-2017-0081. hdl:10419/253806. S2CID 158379317.

- ↑ Aguirre Sotelo, Jose Antonio Manuel; Block, Walter E. (2014-12-31). "Indifference Curve Analysis: The Correct and the Incorrect". Oeconomia Copernicana. 5 (4): 7–43. doi:10.12775/OeC.2014.025. ISSN 2353-1827.

- ↑ Steinberg, Laurence (July 2013). "The influence of neuroscience on US Supreme Court decisions about adolescents' criminal culpability". Nature Reviews Neuroscience. 14 (7): 513–518. doi:10.1038/nrn3509. ISSN 1471-003X. PMID 23756633. S2CID 12544303.

- ↑ Harrison, Glenn W.; Rutström, E. Elisabet (2008), "Risk Aversion in the Laboratory", Research in Experimental Economics, Bingley: Emerald (MCB UP ), vol. 12, pp. 41–196, doi:10.1016/s0193-2306(08)00003-3, ISBN 978-0-7623-1384-6, retrieved 2023-04-23

- ↑ Appelt, Kirstin C.; Milch, Kerry F.; Handgraaf, Michel J. J.; Weber, Elke U. (April 2011). "The Decision Making Individual Differences Inventory and guidelines for the study of individual differences in judgment and decision-making research". Judgment and Decision Making. 6 (3): 252–262. doi:10.1017/S1930297500001455. ISSN 1930-2975. S2CID 2468108.

- ↑ Beshears, John; Choi, James; Laibson, David; Madrian, Brigitte (May 2008). "How are Preferences Revealed?" (PDF). Journal of Public Economics. Cambridge, MA. 92 (8–9): 1787–1794. doi:10.3386/w13976. PMC 3993927. PMID 24761048.

- ↑ Charness, Gary; Gneezy, Uri; Imas, Alex (March 2013). "Experimental methods: Eliciting risk preferences". Journal of Economic Behavior & Organization. 87: 43–51. doi:10.1016/j.jebo.2012.12.023.

- ↑ Mata, Rui; Frey, Renato; Richter, David; Schupp, Jürgen; Hertwig, Ralph (2018-05-01). "Risk Preference: A View from Psychology". Journal of Economic Perspectives. 32 (2): 155–172. doi:10.1257/jep.32.2.155. hdl:21.11116/0000-0001-5038-6. ISSN 0895-3309. PMID 30203934.

- 1 2 3 4 Schulz, Armin W. (2015). "Preferences Vs. Desires: Debating the Fundamental Structure of Conative States". Economics and Philosophy. 31 (2): 239–257. doi:10.1017/S0266267115000115. S2CID 155414997.

- 1 2 Pettit, Philip. "Desire - Routledge Encyclopedia of Philosophy". www.rep.routledge.com. Retrieved 4 May 2021.

- 1 2 3 4 Schroeder, Tim (2020). "Desire". The Stanford Encyclopedia of Philosophy. Metaphysics Research Lab, Stanford University. Retrieved 3 May 2021.

- ↑ Steven, Keith. "What Is A Preference Under The Insolvency Act 1986". Retrieved October 1, 2018.

- 1 2 Hannigan, Brenda (2015). Company Law, Fourth Edition. Oxford: Oxford University Press. p. 368. ISBN 9780198722861.

- ↑ Gullifer, Louise; Payne, Jennifer (2015). Corporate Finance Law: Principles and Policy, Second Edition. Oxford: Bloomsbury Publishing. p. 111. ISBN 9781782259602.

- ↑ Green, Elliot. "Green v Ireland [2011] EWHC 1305 (Ch)". Retrieved December 1, 2022.

General

- Brehm, J.W. (1956). Post-decision changes in desirability of choice alternatives. Journal of Abnormal and Social Psychology, 52, 384–389.

- Coppin, G., Delplanque, S., Cayeux, I., Porcherot, C., & Sander, D. (2010). I'm no longer torn after choice: How explicit choices can implicitly shape preferences for odors. Psychological Science, 21, 489–493.

- Lichtenstein, S., & Slovic, P. (2006). The construction of preference. New York: Cambridge University Press.

- Scherer, K.R. (2005). What are emotions? And how can they be measured? Social Science Information, 44, 695–729.

- Sharot, T., De Martino, B., & Dolan, R.J. (2009). How choice reveals and shapes expected hedonic outcome. Journal of Neuroscience, 29, 3760–3765.

External links

- Stanford Encyclopedia of Philosophy article on 'Preferences'

- Customer preference formation

DOC (white paper from International Communications Research)

DOC (white paper from International Communications Research)