| Rothschild | |

|---|---|

| Jewish noble banking family | |

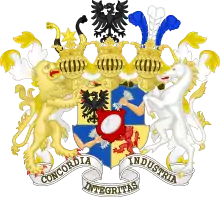

Coat of arms granted to the Barons Rothschild in 1822 by Emperor Francis I of Austria | |

| Current region | Western Europe (mainly United Kingdom, France, and Germany)[1] |

| Etymology | Rothschild (German): 'red shield' |

| Place of origin | Frankfurter Judengasse, Frankfurt, Holy Roman Empire |

| Founded | 1760s (1577) |

| Founder | Mayer Amschel Rothschild (1744–1812) (Elchanan Rothschild, b. 1577) |

| Titles | List

|

| Traditions | Goût Rothschild |

| Motto | Concordia, Integritas, Industria (Latin for 'Harmony, Integrity, Industry') |

| Estate(s) | |

| Cadet branches | |

| Website | rothschildarchive.org |

The Rothschild family (/ˈrɒθ(s)tʃaɪld/ ROTH(S)-chylde German: [ˈʁoːt.ʃɪlt]) is a wealthy Ashkenazi Jewish noble banking family originally from Frankfurt that rose to prominence with Mayer Amschel Rothschild (1744–1812), a court factor to the German Landgraves of Hesse-Kassel in the Free City of Frankfurt, Holy Roman Empire, who established his banking business in the 1760s.[2] Unlike most previous court factors, Rothschild managed to bequeath his wealth and established an international banking family through his five sons,[3] who established businesses in London, Paris, Frankfurt, Vienna, and Naples. The family was elevated to noble rank in the Holy Roman Empire and the United Kingdom.[4][5] The family's documented history starts in 16th century Frankfurt; its name is derived from the family house, Rothschild, built by Isaak Elchanan Bacharach in Frankfurt in 1567.

During the 19th century, the Rothschild family possessed the largest private fortune in the world, as well as in modern world history.[6][7][8] The family's wealth declined over the 20th century, and was divided among many descendants.[9] Today, their interests cover a diverse range of fields, including financial services, real estate, mining, energy, agriculture, winemaking, and nonprofits.[10][11] Many examples of the family's rural architecture exist across northwestern Europe. The Rothschild family has frequently been the subject of conspiracy theories, many of which have antisemitic origins.[12]

Overview

The first member of the family who was known to use the name "Rothschild" was Isaak Elchanan Rothschild, born in 1577. The name is derived from the German zum rothen Schild (with the old spelling "th"), meaning "at the red shield", in reference to the house where the family lived for many generations (in those days, houses were designated not by numbers, but by signs displaying different symbols or colours). A red shield can still be seen at the centre of the Rothschild coat of arms. The family's ascent to international prominence began in 1744, with the birth of Mayer Amschel Rothschild in Frankfurt am Main, Germany. He was the son of Amschel Moses Rothschild (born circa 1710),[13] a money changer who had traded with the Prince of Hesse. Born in the "Judengasse", the ghetto of Frankfurt, Mayer developed a finance house and spread his empire by installing each of his five sons in the five main European financial centres to conduct business. The Rothschild coat of arms contains a clenched fist with five arrows symbolising the five dynasties established by the five sons of Mayer Rothschild, in a reference to Psalm 127: "Like arrows in the hands of a warrior, so are the children of one's youth." The family motto appears below the shield: Concordia, Integritas, Industria (Unity, Integrity, Industry).[14]

.JPG.webp)

Paul Johnson writes "[T]he Rothschilds are elusive. There is no book about them that is both revealing and accurate. Libraries of nonsense have been written about them... A woman who planned to write a book entitled Lies about the Rothschilds abandoned it, saying: 'It was relatively easy to spot the lies, but it proved impossible to find out the truth.'" Johnson writes that, unlike the court factors of earlier centuries, who had financed and managed European noble houses, but often lost their wealth through violence or expropriation, the new kind of international bank created by the Rothschilds was impervious to local attacks. Their assets were held in financial instruments, circulating through the world as stocks, bonds and debts. Changes made by the Rothschilds allowed them to insulate their property from local violence: "Henceforth their real wealth was beyond the reach of the mob, almost beyond the reach of greedy monarchs."[15] Johnson argued that their fortune was generated to the greatest extent by Nathan Mayer Rothschild in London; however, more recent research by Niall Ferguson indicates that greater and equal profits also were realised by the other Rothschild dynasties, including James Mayer de Rothschild in Paris, Carl Mayer von Rothschild in Naples and Amschel Mayer Rothschild in Frankfurt.[16]

Another essential part of Mayer Rothschild's strategy for success was to keep control of their banks in family hands, allowing them to maintain full secrecy about the size of their fortunes. In about 1906, the Jewish Encyclopedia noted: "The practice initiated by the Rothschilds of having several brothers of a firm establish branches in the different financial centres was followed by other Jewish financiers, like the Bischoffsheims, Pereires, Seligmans, Lazards and others, and these financiers by their integrity and financial skill obtained credit not alone with their Jewish confrères, but with the banking fraternity in general. By this means, Jewish financiers obtained an increasing share of international finance during the middle and last quarter of the 19th century. The head of the whole group was the Rothschild family..." It also says: "Of more recent years, non-Jewish financiers have learned the same cosmopolitan method, and, on the whole, the control is now rather less than more in Jewish hands than formerly."[17] Mayer Rothschild successfully kept the fortune in the family with carefully arranged marriages, often between first- or second-cousins (similar to royal intermarriage). By the late 19th century, however, almost all Rothschilds had started to marry outside the family, usually into the aristocracy or other financial dynasties.[18] His sons were:

- Amschel Mayer Rothschild (1773–1855): Frankfurt, died childless as his fortune passed to the sons of Salomon and Kalman

- Salomon Mayer Rothschild (1774–1855): Vienna

- Nathan Mayer Rothschild (1777–1836): London

- Kalman Mayer Rothschild (1788–1855): Naples

- Jakob Mayer Rothschild (1792–1868): Paris

The German family name "Rothschild" is pronounced [ˈʁoːt.ʃɪlt] in German, unlike /ˈrɒθ(s)tʃaɪld/ in English. The surname "Rothschild" is rare in Germany.[19]

Families by country:

- Rothschild banking family of Austria

- Rothschild banking family of England

- Rothschild banking family of Naples

- Rothschild banking family of France

The five sons of Mayer Amschel Rothschild were elevated to the Austrian nobility by Emperor Francis I of Austria, and they were all granted the Austrian hereditary title of Freiherr (baron) on 29 September 1822.[20] The British branch of the family was elevated by Queen Victoria, who granted the hereditary title of baronet (1847)[21] and later the hereditary peerage title of Baron Rothschild (1885).[22]

The Napoleonic Wars

The Rothschilds already possessed a significant fortune before the start of the Napoleonic Wars (1803–1815), and the family had gained preeminence in the bullion trade by this time.[23] From London in 1813 to 1815, Nathan Mayer Rothschild was instrumental in almost single-handedly financing the British war effort, organising the shipment of bullion to the Duke of Wellington's armies across Europe, as well as arranging the payment of British financial subsidies to their continental allies. In 1815 alone, the Rothschilds provided £9.8 million (equivalent to about £710 million in 2019) in subsidy loans to Britain's continental allies.[24]

The brothers helped coordinate Rothschild activities across the continent, and the family developed a network of agents, shippers and couriers to transport gold across war-torn Europe. The family network was also to provide Nathan Rothschild time and again with political and financial information ahead of his peers, giving him an advantage in the markets and rendering the house of Rothschild still more invaluable to the British government.

In one instance, the family network enabled Nathan to receive in London the news of Wellington's victory at the Battle of Waterloo a full day ahead of the government's official messengers.[23] Rothschild's first concern on this occasion was not to the potential financial advantage on the market which the knowledge would have given him; he and his courier immediately took the news to the government.[23] That he used the news for financial advantage was a fiction then repeated in later popular accounts, such as that of Morton.[25][26] The basis for the Rothschilds' most famously profitable move was made after the news of British victory had been made public. Nathan Rothschild calculated that the future reduction in government borrowing brought about by the peace would create a bounce in British government bonds after a two-year stabilisation, which would finalise the post-war restructuring of the domestic economy.[24][25][26] In what has been described as one of the most audacious moves in financial history, Nathan immediately bought up the government bond market, for what at the time seemed an excessively high price, before waiting two years, then selling the bonds on the crest of a short bounce in the market in 1817 for a 40% profit. Given the sheer power of leverage the Rothschild family had at their disposal, this profit was an enormous sum.[24]

Nathan Mayer Rothschild started his business in Manchester in 1806 and gradually moved it to London, where in 1809 he acquired the location at 2 New Court in St. Swithin's Lane, City of London,[23] where it operates today; he established N M Rothschild & Sons in 1811.[27][28] In 1818, he arranged a £5 million (equal to £360 million in 2019) loan to the Prussian government, and the issuing of bonds for government loans formed a mainstay of his bank's business. He gained a position of such power in the City of London that by 1825–26 he was able to supply enough coin to the Bank of England to enable it to avert a market liquidity crisis.

International high finance

| "I have not the nerve for his operations. They are well-planned, with great cleverness and adroitness in execution – but he is in money and funds what Napoleon was in war." —Baron Baring on Nathan Rothschild[29] |

| "... your friends at the West End have the business in their hands to decide between Portugal & Brazil and an early intimation from you may serve us materially."—Samuel Phillips & Co to Nathan Rothschild, referring to the question on whether or not to support Brazilian independence[30] |

Rothschild family banking businesses pioneered international high finance during the industrialisation of Europe and were instrumental in supporting railway systems across the world and in complex government financing for projects such as the Suez Canal. From 1895 through 1907 they loaned nearly $450,000,000 (equivalent to $14,100,000,000 in 2022[31]) to European governments.[32] During the 19th century, the family bought up a large proportion of the property in Mayfair, London.[33]

The Rothschild family was directly involved in the independence of Brazil from Portugal in the early 19th century. Upon an agreement, the Brazilian government should pay a compensation of two million pounds sterling to the Kingdom of Portugal to accept Brazil's independence.[30] N M Rothschild & Sons was pre-eminent in raising this capital for the government of the newly formed Empire of Brazil on the London market. In 1825, Nathan Rothschild raised £2,000,000, and indeed was probably discreetly involved in the earlier tranche of this loan which raised £1,000,000 in 1824.[30][34] Part of the price of Portuguese recognition of Brazilian independence, secured in 1825, was that Brazil should take over repayment of the principal and interest on a £1,500,000 loan made to the Portuguese government in 1823 by N M Rothschild & Sons.[30] A correspondence from Samuel Phillips & Co. in 1824 suggests the close involvement of the Rothschilds in the occasion.

Major 19th-century businesses founded with Rothschild family capital include:

- Alliance Assurance (1824) (now Royal & Sun Alliance)

- Chemin de Fer du Nord (1845)

- The Rio Tinto mining company (1873) (from the 1880s onwards, the Rothschilds had full control of Rio Tinto)[35]

- Eramet (1880)

- Imerys (1880)

- De Beers (1888)

The family funded Cecil Rhodes in the creation of the African colony of Rhodesia. From the late 1880s onwards, the family took over control of the Rio Tinto mining company.

The Japanese government approached the London and Paris families for funding during the Russo-Japanese War. The London consortium's issue of Japanese war bonds would total £11.5 million (at 1907 currency rates; £1.08 billion in 2012 currency terms).[36]

The name of Rothschild became synonymous with extravagance and great wealth; and the family was renowned for its art collecting, for its palaces, as well as for its philanthropy. By the end of the century, the family owned, or had built, at the lowest estimates, 41 palaces, of a scale and luxury perhaps unparalleled even by the richest royal families.[24] The British Chancellor of the Exchequer David Lloyd George claimed, in 1909, that Nathan, Lord Rothschild was the most powerful man in Britain.[6][37]

Niles' Weekly Register, Volume 49 had the following to say about the Rothschilds' influence on international high finance in 1836:

The Rothschilds are the wonders of modern banking ... we see the descendants of Judah, after a persecution of two thousand years, peering above kings, rising higher than emperors, and holding a whole continent in the hollow of their hands. The Rothschilds govern a Christian world. Not a cabinet moves without their advice. They stretch their hand, with equal ease, from [Saint] Petersburgh to Vienna, from Vienna to Paris, from Paris to London, from London to Washington. Baron Rothschild, the head of the house, is the true king of Judah, the prince of the captivity, the Messiah so long looked for by this extraordinary people. He holds the keys of peace or war, blessing or cursing. ... They are the brokers and counselors of the kings of Europe and of the republican chiefs of America. What more can they desire?[38]

Changes to family fortunes

The Neapolitan Rothschilds was the first branch of the family to decline when revolution broke out and Giuseppe Garibaldi captured Naples on 7 September 1860 and set up a provisional Italian government. Because of the family's close political connections with Austria and France, Adolphe Carl von Rothschild was caught in a delicate position. He chose to take temporary sanctuary in Gaeta with the last Neapolitan king, Francis II of the Two Sicilies. However, the Rothschild branches in London, Paris, and Vienna were not prepared nor willing to financially support the deposed king. With the ensuing unification of Italy, and the mounting tension between Adolph and the rest of the family, the Naples house closed in 1863 after forty-two years in business.

In 1901, the German branch closed its doors after more than a century in business following the death of Wilhelm Rothschild with no male heirs. It was not until 1989 that the family returned to Germany, when N M Rothschild & Sons, the British branch, plus Bank Rothschild AG, the Swiss branch, set up a representative banking office in Frankfurt.

By the start of the 20th century, the introduction of national taxation systems had ended the Rothschilds' policy of operating with a single set of commercial account records, which resulted in the various branches gradually going their own separate ways as independent banks. The system of the five brothers and their successor sons all but disappeared by World War I.[39]

The rise of Nazi Germany in the 1930s led to a precarious situation for the Austrian Rothschilds under the annexation of Austria in 1938 when the family was pressured to sell its banking operation at a fraction of its real worth. While other Rothschilds had escaped the Nazis, Louis Rothschild was imprisoned for a year and only released after a substantial ransom was paid by his family. After Louis was allowed to leave the country in March 1939, the Nazis placed the firm of S M von Rothschild under compulsory administration. Nazi officers and senior staff from Austrian museums also emptied the Rothschild family estates of all their valuables. Following the war, the Austrian Rothschilds were unable to reclaim much of their former assets and properties.

Later, the fall of France during the Second World War led to the seizure of the property of the French Rothschilds under German occupation. Despite having their bank restored to them at the end of the war, the French Rothschilds were powerless in 1982 as the family business was nationalised by the socialist government of newly elected President François Mitterrand.[40]

In addition, The New York Times wrote that the Rothschilds "grossly misjudged the opportunities directly across the Atlantic" and quoted Evelyn de Rothschild as saying that despite the accomplishments made by the various branches of the family in international high finance for over 200 years, "we never seized the initiative in America and that was one of the mistakes my family made."[41]

Hereditary titles

In 1816, four of the five sons of Mayer Amschel Rothschild were elevated to the Austrian nobility by Emperor Francis I of Austria.[20] The remaining son, Nathan, was elevated in 1818. All of them were granted the Austrian hereditary title of Freiherr (baron) on 29 September 1822.[20] As a result, some members of the family used the nobiliary particle de or von before their surname to acknowledge the grant of nobility.

In 1847, Anthony de Rothschild was made a hereditary baronet of the United Kingdom.[42] In 1885, Sir Nathan Rothschild, 2nd Baronet, was granted the hereditary peerage title of Baron Rothschild in the Peerage of the United Kingdom.[22] This title is currently held by the 4th Baron Rothschild.

English branch

The Rothschild banking family of England was founded in 1798 by Nathan Mayer Rothschild (1777–1836), who first settled in Manchester but then moved to London. Nathan Mayer von Rothschild, the third son of Mayer Amschel Rothschild (1744–1812), first established a textile jobbing business in Manchester and from there went on to establish N M Rothschild & Sons bank in London.[43]

During the early part of the 19th century, the Rothschild family's London bank took a leading part in managing and financing the subsidies that the British government transferred to its allies during the Napoleonic Wars. Through the creation of a network of agents, couriers and shippers, the bank was able to provide funds to the armies of the Duke of Wellington in Portugal and Spain, therefore funding the war. The providing of other innovative and complex financing for government projects formed a mainstay of the bank's business for the better part of the century. N M Rothschild & Sons' financial strength in the City of London became such that, by 1825–26, the bank was able to supply enough coin to the Bank of England to enable it to avert a liquidity crisis.

Nathan Mayer's eldest son, Lionel de Rothschild (1808–1879), succeeded him as head of the London branch. Under Lionel, the bank financed the British government's 1875 purchase of Egypt's interest in the Suez Canal. The Rothschild bank also funded Cecil Rhodes in the development of the British South Africa Company. Leopold de Rothschild (1845–1917) administered Rhodes's estate after his death in 1902 and helped to set up the Rhodes Scholarship scheme at the University of Oxford. In 1873, de Rothschild Frères in France and N M Rothschild & Sons of London joined with other investors to acquire the Spanish government's money-losing Rio Tinto copper mines. The new owners restructured the company and turned it into a profitable business. By 1905, the Rothschild interest in Rio Tinto amounted to more than 30 percent. In 1887, the French and British Rothschild banking houses loaned money to, and invested in, the De Beers diamond mines in South Africa, becoming its largest shareholders.

The London banking house continued under the management of Lionel Nathan de Rothschild (1882–1942) and his brother Anthony Gustav de Rothschild (1887–1961), and then to Sir Evelyn de Rothschild (1931–2022). In 2003, following Sir Evelyn's retirement as head of N M Rothschild & Sons of London, the British and French financial firms merged under the leadership of David René de Rothschild.

French branches

There are two branches of the family connected to France.

The first was the branch of James Mayer de Rothschild (1792–1868), known as "James", who established de Rothschild Frères in Paris; he married his niece Betty von Rothschild. Following the Napoleonic Wars, he played a major role in financing the construction of railways and the mining business that helped make France an industrial power. By 1980, the Paris business employed about 2,000 people and had an annual turnover of 26 billion francs (€4.13 billion or $5 billion in the currency rates of 1980).[44]

| "No kings could afford this! It could only belong to a Rothschild."

— Wilhelm I, Emperor of Germany, on visiting Château de Ferrières.[45] |

However, the Paris business suffered a near death blow in 1982, when the socialist government of François Mitterrand nationalised and renamed it as Compagnie Européenne de Banque.[46] Baron David de Rothschild, then 39, decided to stay and rebuild, creating a new entity named Rothschild & Cie Banque, with just three employees and €830,000 (US$1 million) in capital. Today, the Paris operation has 22 partners and accounts for a significant part of the global business.

Ensuing generations of the Paris Rothschild family remained involved in the family business, becoming a major force in international investment banking. The Paris Rothschilds have since led the Thomson Financial League Tables in Investment Banking Merger and Acquisition deals in the UK, France and Italy.

James Mayer de Rothschild's other son, Edmond James de Rothschild (1845–1934), was very much engaged in philanthropy and the arts, and he was a leading proponent of Zionism. His grandson, Baron Edmond Adolphe de Rothschild, founded in 1953 the LCF Rothschild Group, a private bank. Since 1997, Baron Benjamin de Rothschild chairs the group. The group has €100bn of assets in 2008 and owns many wine properties in France (Château Clarke, Château des Laurets), in Australia or in South Africa. In 1961, the 35-year-old Edmond Adolphe de Rothschild purchased the company Club Med, after he had visited a resort and enjoyed his stay.[47][48] His interest in Club Med was sold off by the 1990s. In 1973, he bought out the Bank of California, selling his interests in 1984 before it was sold to Mitsubishi Bank in 1985.

The second French branch was founded by Nathaniel de Rothschild (1812–1870). Born in London, he was the fourth child of the founder of the British branch of the family, Nathan Mayer Rothschild (1777–1836). In 1850 Nathaniel Rothschild moved to Paris to work with his uncle James Mayer Rothschild. In 1853 Nathaniel acquired Château Brane Mouton, a vineyard in Pauillac in the Gironde département. Nathaniel Rothschild renamed the estate Château Mouton Rothschild, and it would become one of the best known labels in the world. In 1868, Nathaniel's uncle, James Mayer de Rothschild, acquired the neighbouring Château Lafite vineyard.

Austrian branch

In Vienna, Salomon Mayer Rothschild established a bank in the 1820s and the Austrian family had vast wealth and position.[49] The crash of 1929 brought problems, and Baron Louis von Schwartz Rothschild attempted to shore up the Creditanstalt, Austria's largest bank, to prevent its collapse. Nevertheless, during the Second World War they had to surrender their bank to the Nazis and flee the country. Their Rothschild palaces, a collection of vast palaces in Vienna built and owned by the family, were confiscated, plundered and destroyed by the Nazis. The palaces were famous for their sheer size and for their huge collections of paintings, armour, tapestries and statues (some of which were restored to the Rothschilds by the Austrian government in 1999). All family members escaped the Holocaust, some of them moving to the United States, and returning to Europe only after the war. In 1999, the government of Austria agreed to return to the Rothschild family some 250 art treasures looted by the Nazis and absorbed into state museums after the war.[50]

Neapolitan branch

The C M de Rothschild & Figli bank arranged substantial loans to the Papal States and to various Kings of Naples plus the Duchy of Parma and the Grand Duchy of Tuscany. However, in the 1830s, Naples followed Spain with a gradual shift away from conventional bond issues that began to affect the bank's growth and profitability. The Unification of Italy in 1861, with the ensuing decline of the Italian aristocracy who had been the Rothschilds' primary clients, eventually brought about the closure of their Naples bank, due to a forecasted decline in the sustainability of the business over the long-term. However, in the early 19th century, the Rothschild family of Naples built up close relations with the Holy See, and the association between the family and the Vatican continued into the 20th century. In 1832, when Pope Gregory XVI was seen meeting Carl von Rothschild to arrange the 1832 Rothschild loan to the Holy See (for £400,000, worth €43,000,000 in 2014), observers were shocked that Rothschild was not required to kiss the Pope's feet, as was then required for all other visitors to the Pope, including monarchs.[51] The 1906 Jewish Encyclopedia described the Rothschilds as "the guardians of the papal treasure".[52]

Jewish identity and positions on Zionism

Jewish solidarity in the family was not homogeneous. Many Rothschilds were supporters of Zionism, while other members of the family opposed the creation of the Jewish state. In 1917 Walter Rothschild, 2nd Baron Rothschild was the addressee of the Balfour Declaration to the Zionist Federation,[53] which committed the British government to the establishment in Palestine of a national home for the Jewish people. His nephew, Victor, Lord Rothschild was against granting asylum or helping Jewish refugees in 1938.[lower-alpha 1][54]

After the death of James Jacob de Rothschild in 1868, his eldest son Alphonse Rothschild took over the management of the family bank and was the most active in support for Eretz Israel.[55] The Rothschild family archives show that during the 1870s the family contributed nearly 500,000 francs per year on behalf of Eastern Jewry to the Alliance Israélite Universelle.[56]

Baron Edmond James de Rothschild (known in Israel simply as "the Baron Rothschild" or "the Benefactor" (Hebrew: "HaNadiv"), youngest son of James Jacob de Rothschild, was a patron of the first permanent settlement in Palestine at Rishon-LeZion (1882). He also provided funding for the establishment of Petah Tikva as a permanent settlement (1883). Overall, he bought from Ottoman landlords 2–3% of the land which now makes up present-day Israel.[57][lower-alpha 2] After Baron de Hirsch died in 1896, the Hirsch-founded Jewish Colonisation Association (ICA) started supporting the settlement of Palestine (1896), and Baron Rothschild took an active role in the organization and transferred his Palestinian land holdings as well as 15 million francs to it. In 1924, he reorganized the Palestinian branch of the ICA into the Palestine Jewish Colonisation Association (PICA), which acquired more than 125,000 acres (50,586 ha) of land and set up business ventures.[58] In Tel Aviv, the Rothschild Boulevard is named after him, as are a number of localities throughout Israel which he assisted in founding, including Metulla, Zikhron Ya'akov, Rishon Lezion and Rosh Pina. A park in Boulogne-Billancourt, Paris, the Parc Edmond de Rothschild (Edmond de Rothschild Park), is also named after its founder.[59] The Rothschilds also played a significant part in the funding of Israel's governmental infrastructure. James A. de Rothschild financed the Knesset building as a gift to the State of Israel[60] and the Supreme Court of Israel building was donated to Israel by Dorothy de Rothschild.[61] Outside the President's Chamber is displayed the letter Dorothy de Rothschild wrote to then Prime Minister Shimon Peres expressing her intention to donate a new building for the Supreme Court.[62]

Interviewed by Haaretz in 2010, Baron Benjamin Rothschild, who was a Swiss-based member of the banking family, said that he supported the Israeli–Palestinian peace process: "I understand that it is a complicated business, mainly because of the fanatics and extremists – and I am talking about both sides. I think you have fanatics in Israel. ... In general I am not in contact with politicians. I spoke once with Netanyahu. I met once with an Israeli finance minister, but the less I mingle with politicians the better I feel."[63] Due to a dispute with the Israeli tax authorities, the baron refused to visit Israel. But his widow Ariane de Rothschild often visits Israel where she manages the Caesarea Foundation. She says: "It is insulting that the state [Israel] casts doubt on us. If there is a family that does not have to prove its commitment to Israel, it's ours."[64]

Places in Israel named after Rothschild family members

Primarily due to the generosity and influence of Baron Edmond James de Rothschild, HaNadiv (the Benefactor), on the history of the Land of Israel and the State of Israel, a tradition exists of naming cities, towns and other settlements in Israel in honor of members of the Rothschild family. Six of these places are grouped in the same vicinity, on the Sharon plain, while the others are scattered throughout the country. They are, listed in order of founding:

- Zichron Ya'akov (Hebrew: Jacob's Memory), a town founded in 1882 and named after the Benefactor's father, James [Jacob] Mayer de Rothschild (1792–1868) from the Paris branch of the family;

- Mazkeret Batya (Hebrew: Remembrance of Batya), a local council near Tel Aviv, founded in 1883 and named after Betty von Rothschild (1805–1886), the Benefactor's mother;

- Bat Shlomo (Hebrew: Salomon's Daughter), a moshav near Rehovot, founded in 1889 and also named after the Baron's mother, who was the daughter of Salomon Mayer von Rothschild (1774–1855), the Benefactor's grandfather from the Vienna branch;

- Meir Shfeya (Hebrew: Mayer's Fields), a youth village near Zichron Ya'acov, founded as a moshava in 1891 and named after Amschel Mayer von Rothschild (1773–1855), the Benefactor's grandfather from the Frankfurt branch;

- Givat Ada (Hebrew: Ada's Hill), a town near Zichron Ya'acov, founded in 1903 and named after the Benefactor's wife Adelheid von Rothschild (1853–1935), who was also his cousin, from the Naples branch;

- Binyamina, a town near Zichron Ya'acov, founded in 1922 and named after Benefactor himself (Binyamina was officially merged with Givat Ada in 2003);

- Ashdot Ya'akov (Hebrew: Jacob's Rapids), a kibbutz just south of the Sea of Galilee, founded in 1924 and named after James Armand Edmond de Rothschild (1878–1957), son of the Benefactor;

- Pardes Hanna (Hebrew: Hannah's [Citrus] Orchard), a local council near Zichron Ya'acov, founded in 1929 and named after Hannah Primrose, Countess of Rosebery née de Rothschild (1851–1890), daughter of Mayer Anschel Rothschild;[65][66][67]

- Shadmot Dvora (Hebrew: Deborah's Cultivated Fields), a moshav near Tiberias, founded in 1939 and named after Dorothy de Rothschild (1895–1988), who was James de Rothschild's wife and the Benefactor's daughter-in-law;

- Sde Eliezer (Hebrew: Eliezer's Field), a moshav in the Hula Valley, founded in 1950 and named after Robert Rothschild (1911–1998), a relative of the Benefactor's of the French branch.[68]

Modern businesses, investments, and philanthropy

Since the late 19th century, the family has taken a low-key public profile, donating many famous estates, as well as vast quantities of art, to charity, and generally eschewing conspicuous displays of wealth. Today, Rothschild businesses are on a smaller scale than they were throughout the 19th century, although they encompass a diverse range of fields, including: real estate, financial services, mixed farming, energy, mining, winemaking and nonprofits.[10][11]

The Rothschild Group

Since 2003, a group of Rothschild banks have been controlled by Rothschild Continuation Holdings, a Swiss-registered holding company (under the chairmanship of Baron David René de Rothschild). Rothschild Continuation Holdings is in turn controlled by Concordia BV, a Dutch-registered master holding company. Concordia BV is managed by Paris Orléans S.A., a French-registered holding company.[69] Paris Orléans S.A. is ultimately controlled by Rothschild Concordia SAS, a Rothschild's family holding company.[70] Rothschild & Cie Banque controls Rothschild banking businesses in France and continental Europe, while Rothschilds Continuation Holdings AG controls a number of Rothschild banks elsewhere, including N M Rothschild & Sons in London. Twenty per cent of Rothschild Continuation Holdings AG was sold in 2005 to Jardine Strategic, which is a subsidiary of Jardine, Matheson & Co. of Hong Kong. In November 2008, Rabobank Group, the leading investment and private bank in the Netherlands, acquired 7.5% of Rothschild Continuation Holdings AG, and Rabobank and Rothschild entered into a co-operation agreement in the fields of mergers and acquisitions (M&A) advisory and equity capital markets advisory in the food and agribusiness sectors.[71] It was believed that the move was intended to help Rothschild Continuation Holdings AG gain access to a wider capital pool, enlarging its presence in East Asian markets.[72]

Paris Orléans S.A. is a financial holding company listed on Euronext Paris and controlled by the French and English branches of the Rothschild family. Paris Orléans is the flagship of the Rothschild banking group and controls the Rothschild Group's banking activities including N M Rothschild & Sons and Rothschild & Cie Banque. It has over 2,000 employees. Directors of the company include Eric de Rothschild, Robert de Rothschild and Count Philippe de Nicolay.[73]

N M Rothschild & Sons, an English investment bank, does most of its business as an advisor for mergers and acquisitions. In 2004, the investment bank withdrew from the gold market, a commodity the Rothschild bankers had traded in for two centuries.[54] In 2006, it ranked second in UK M&A with deals totalling $104.9 billion.[74] In 2006, the bank recorded a pre-tax annual profit of £83.2 million with assets of £5.5 billion.[75]

| "Treat the stock exchange like a cold shower (quick in, quick out)." |

Edmond de Rothschild Group

In 1953, one Swiss member of the family, Edmond Adolphe de Rothschild (1926–1997), founded the LCF Rothschild Group (now Edmond de Rothschild Group) which is based in Geneva and today extends to 15 countries across the world. Although this group is primarily a financial entity, specializing in asset management and private banking, its activities also cover mixed farming, luxury hotels and yacht racing. Edmond de Rothschild Group's committee is currently being chaired by Ariane de Rothschild.

In late 2010, Baron Benjamin Rothschild, the chairman at the time, said that the family had been unaffected by the financial crisis of 2007–2010, due to their conservative business practices: "We came through it well, because our investment managers did not want to put money into crazy things." He added that the Rothschilds were still a small-scale, traditional family business and took greater care over their clients' investments than American companies, adding: "The client knows we will not speculate with his money".[63][77]

Edmond de Rothschild group includes these companies.

- Banque privée Edmond de Rothschild – Swiss private banking firm

- Compagnie Financière Edmond de Rothschild – French private bank

- La Compagnie Benjamin de Rothschild

- Cogifrance – Real estate

- Compagnie Vinicole Baron Edmond de Rothschild – wine making firm

RIT Capital Partners

In 1980, Jacob Rothschild, 4th Baron Rothschild resigned from N M Rothschild & Sons and took independent control of Rothschild Investment Trust (now RIT Capital Partners, a British investment trust), which has reported assets of $3.4 billion in 2008.[78] It is listed on London Stock Exchange. Lord Rothschild is also one of the major investors behind BullionVault, a gold trading platform.[79]

In 2010 RIT Capital Partners stored a significant proportion of its assets in the form of physical gold. Other assets included oil and energy-related investments.[80]

In 2012, RIT Capital Partners announced it was to buy a 37 per cent stake in a Rockefeller family wealth advisory and asset management group.[81] Commenting on the deal, David Rockefeller, a former patriarch of the Rockefeller family, said: "The connection between our two families remains very strong."[82]

Investments

In 1991, Jacob Rothschild, 4th Baron Rothschild founded J. Rothschild Assurance Group (now St. James's Place Wealth Management) with Sir Mark Weinberg. It is also listed on London Stock Exchange.[83]

In 2001, the Rothschild mansion located at 18 Kensington Palace Gardens, London, was on sale for £85 million, at that time (2001) the most expensive residential property ever to go on sale in the world. It was built in marble, at 9,000 sq ft, with underground parking for 20 cars.[84]

In December 2009, Jacob Rothschild, 4th Baron Rothschild invested $200 million of his own money in a North Sea oil company.[85]

In January 2010, Nathaniel Philip Rothschild bought a substantial share of the Glencore mining and oil company's market capitalisation. He also bought a large share of the aluminium mining company United Company RUSAL.[86]

During the 19th century, the Rothschilds controlled the Rio Tinto mining corporation, and to this day, Rothschild and Rio Tinto maintain a close business relationship.[87]

Wine

The Rothschild family has been in the winemaking industry for 150 years.[88] In 1853, Nathaniel de Rothschild purchased Château Brane-Mouton and renamed it Château Mouton Rothschild. In 1868, James Mayer de Rothschild purchased the neighbouring Château Lafite and renamed it Château Lafite Rothschild.

Today, the Rothschild family owns many wine estates: their estates in France include Château Clarke, Château de Malengin, Château Clerc-Milon, Château d'Armailhac, Château Duhart-Milon, Château Lafite Rothschild, Château de Laversine, Château des Laurets, Château L'Évangile, Château Malmaison, Château de Montvillargenne, Château Mouton Rothschild, Château de la Muette, Château Rieussec and Château Rothschild d'Armainvilliers. They also own wine estates across North America, South America, South Africa and Australia.

Especially, Château Mouton Rothschild and Château Lafite Rothschild are classified as Premier Cru Classé—i.e., First Growth, the status referring to a classification of wines from the Bordeaux region of France.

Saskia de Rothschild was named Chairwoman of Château Lafite Rothschild in 2018, succeeding her father, Éric de Rothschild.[89] Château Mouton Rothschild was managed by Philippine de Rothschild until her death in 2014. It is now under the direction of her son Philippe Sereys de Rothschild.[90]

Art and charity

The family once had one of the largest private art collections in the world, and a significant proportion of the art in the world's public museums are Rothschild donations which were sometimes, in the family tradition of discretion, donated anonymously.[91]

Hannah Mary Rothschild was appointed in December 2014 as chair of the board of the National Gallery of London.[92]

Cultural references

In the words of The Daily Telegraph: "This multinational banking family is a byword for wealth, power – and discretion... The Rothschild name has become synonymous with money and power to a degree that perhaps no other family has ever matched."[93]

Writing of the Rockefeller and Rothschild families, Harry Mount writes: "That is what makes these two dynasties so exceptional – not just their dizzying wealth, but the fact that they have held on to it for so long: and not just the loot, but also their family companies."[94]

The story of the Rothschild family has been featured in a number of films. The 1934 Hollywood film titled The House of Rothschild, starring George Arliss and Loretta Young, recounted the life of Mayer Amschel Rothschild and Nathan Mayer Rothschild (both played by Arliss). Excerpts from this film were incorporated into the Nazi propaganda film Der ewige Jude (The Eternal Jew) without the permission of the copyright holder. Another Nazi film, Die Rothschilds (also called Aktien auf Waterloo), was directed by Erich Waschneck in 1940. A Broadway musical entitled The Rothschilds, covering the history of the family up to 1818, was nominated for a Tony Award in 1971. Nathaniel Mayer ("Natty") Rothschild, 1st Baron Rothschild appears as a minor character in the historical-mystery novel Stone's Fall, by Iain Pears. Mayer Rothschild is featured in Diana Gabaldon's novel Voyager as a coin seller summoned to Le Havre by Jamie Fraser to appraise coins, prior to the establishment of the Rothschild dynasty, when Mayer is in his early 20s. The Rothschild name is mentioned by Aldous Huxley in his novel Brave New World, among many names of historically affluent persons, scientific innovators and others. The character, named Morgana Rothschild, played a relatively minor role in the story. The name Rothschild used as a synonym for extreme wealth inspired the song "If I Were a Rich Man", which is based on a song from the Tevye the Dairyman stories, written in the Yiddish as Ven ikh bin Rotshild, meaning 'If I were a Rothschild'.[95]

In France, the word "Rothschild" was throughout the 19th and 20th centuries a synonym for seemingly endless wealth, neo-Gothic styles, and epicurean glamour.[96] The family also has lent its name to "le goût Rothschild," a suffocatingly glamorous style of interior decoration whose elements include neo-Renaissance palaces, extravagant use of velvet and gilding, vast collections of armour and sculpture, a sense of Victorian horror vacui, and the highest masterworks of art. Le goût Rothschild has influenced designers such as Robert Denning, Yves Saint Laurent, Vincent Fourcade and others.

"Yes, my dear fellow, it all amounts to this: in order to do something first you must be something. We think Dante great, and he had a civilization of centuries behind him; the House of Rothschild is rich and it has required much more than one generation to attain such wealth. Such things all lie much deeper than one thinks."

Conspiracy theories

Over more than two centuries,[25][26] the Rothschild family has frequently been the subject of conspiracy theories.[12][98][99] These theories take differing forms, such as claiming that the family controls the world's wealth and financial institutions[100][101] or encouraged or discouraged wars between governments. Discussing this and similar views, the historian Niall Ferguson wrote that,

Without wars, nineteenth-century states would have little need to issue bonds. As we have seen, however, wars tended to hit the price of existing bonds by increasing the risk that a debtor state would fail to meet its interest payments in the event of defeat and losses of territory. By the middle of the 19th century, the Rothschilds had evolved from traders into fund managers, carefully tending to their own vast portfolio of government bonds. Now having made their money, they stood to lose more than they gained from conflict. [...] The Rothschilds had decided the outcome of the Napoleonic Wars by putting their financial weight behind Britain. Now they would [...] sit on the sidelines.[102]

Many conspiracy theories about the Rothschild family arise from anti-Semitic prejudice and various antisemitic tropes.[103][104][105][106][107][108]

Prominent descendants of Mayer Amschel Rothschild

Prominent lineal descendants of Mayer Amschel Rothschild include among many others:

- Major Alexander Karet (1905–1976)[109][110]

- Adeleheid von Rothschild (1853–1935) x 1877 : Edmond de Rothschild (1845–1934) (see the Paris branch)

- Almina Herbert, Countess of Carnarvon (15 August 1876 – 8 May 1969)

- Prince Alexandre Louis Philippe Marie Berthier (1883–1918), died fighting in the First World War

- Albert Salomon von Rothschild (1844–1911), former majority shareholder of Creditanstalt

- Alfred Charles de Rothschild (20 July 1842 – 31 January 1918)

- Alice Charlotte von Rothschild (1847–1922) close friend of Queen Victoria

- Aline Caroline de Rothschild (1867–1909), French socialite

- Alice Rothschild (born 1983), wife of Zac Goldsmith, after his divorce of Sheherazade Ventura-Bentley

- Lady Aline Caroline Cholmondeley (born 1916)

- Baroness Afdera Franchetti (born c. 1931), a former wife of Henry Fonda, from the noble Italian Jewish Franchetti family

- Baroness Alix Hermine Jeannette Schey de Koromla (1911–1982)[111]

- Alphonse James de Rothschild (1827–1905)

- Amschel Mayor James Rothschild (1955–1996, Paris), patron of motor racing

- Princess Andréa de La Tour d'Auvergne-Lauraguais (born Paris 1972)

- Anthony Gustav de Rothschild (1887–1961), horse-breeder

- Anthony James de Rothschild (born 1977)

- Anselm von Rothschild (1803–1874), Austrian banker

- Anselm Alexander Carl de Rothschild (1835–1854)

- Sir Anthony de Rothschild, 1st Baronet (1810–1876)

- Antoine Armand Odélric Marie Henri de Gramont, 13th Duke of Gramont (born 1951)[112]

- Alain de Rothschild (1910–1982)

- Lady Barbara Marie-Louise Constance Berry (born 1935)

- Arthur de Rothschild (1851–1903)

- Benjamin de Rothschild (1963–2021)

- Princess Béatrice de Broglie (1913–1994)

- Béatrice Ephrussi de Rothschild (1864–1934)

- Bethsabée de Rothschild (1914–1999)

- Carl Mayer von Rothschild (1788–1855)

- Cécile Léonie Eugénie Gudule Lucie de Rothschild (1913–1995)

- Charlotte de Rothschild (1825–1899)

- Charlotte Henriette de Rothschild (born 1955), British opera singer

- Charlotte von Rothschild (1818–84)

- Count Charles-Emmanuel Lannes de Montebello (born 1942)

- Charles Rothschild (1877–1923), banker and entomologist

- Constance Flower, 1st Baroness of Battersea (1843–1931)

- David Cholmondeley, 7th Marquess of Cholmondeley (born 1960), Lord Great Chamberlain of England

- David Mayer de Rothschild (born 1978), billionaire[113] British adventurer and environmentalist

- David René de Rothschild (born 1942)

- Edmond Adolphe de Rothschild (1926–1997)

- Edouard Etienne de Rothschild (born 1957)

- Édouard Alphonse James de Rothschild (1868–1949) financier and polo player

- Prince Edouard de La Tour d'Auvergne-Lauraguais (born 1949)

- Edmond James de Rothschild (1845–1934)

- Edmund Leopold de Rothschild (1916–2009)

- Elie de Rothschild (1917–2007)

- Princess Elisabeth de Broglie (born 1920)

- Emma Rothschild (born 1948)

- Esther de Rothschild (born 1979)

- Evelina de Rothschild (1839–66)

- Evelyn Achille de Rothschild (1886–1917), died fighting for the British Army in the First World War

- Sir Evelyn de Rothschild (1931–2022), banker

- Baron Ferdinand de Rothschild, M.P. (1839–1898)

- Count Gabriel Antoine Armand (1908–1943), a soldier of the French Resistance.

- Gustave Samuel de Rothschild (1829–1911)

- Guy de Rothschild (1909–2007)

- Hannah Primrose, Countess of Rosebery née Hannah Rothschild (1851–1890)

- Hannah Mary Rothschild (born 1962), documentary filmmaker

- Helene Cecile Muhlstein de Rothschild (1936–2007) x 1962 : François Nourissier (1927–2011), président de l'Académie Goncourt

- Henri James de Rothschild (1872–1946), playwright, grandson of Nathaniel de Rothschild

- Henry Herbert, 6th Earl of Carnarvon (1898–1987)

- Duke Hélie Marie Auguste Jacques Bertrand Philippe (1943), 10th Duke of Noailles

- Henriette Rothschild (1791–1866) married Sir Moses Montefiore (1784–1885)

- Count Henri de Gramont (1909–1994)

- Hugh Cholmondeley, 6th Marquess of Cholmondeley (1919–90), Lord Great Chamberlain of England

- Jacqueline de Rothschild (1911–2012) x (1) 1930; Robert Calmann-Lévy (1899–1982) puis x (2) 1937; Gregor Piatigorsky (1903–1976)

- James Amschel Victor Rothschild (born 1985)

- James Armand de Rothschild (1878–1957)

- James Mayer Rothschild (1792–1868)

- Joachim Von Rothschild (1929–1998)

- Marie Angliviel de la Beaumelle (1963–2013)

- Neil Primrose, 7th Earl of Rosebery (born 1929)

- Neil James Archibald Primrose (1882–1917), MP, killed fighting in the First World War

- Baroness Nica de Koenigswarter (née Baroness Pannonica Rothschild) (1913–1988), patron of bebop and jazz writer – often called the "Jazz Baroness"

- Baron Léon Lambert (1929–1987), Belgian art collector[114]

- Leopold de Rothschild (1845–1917)

- Leopold David de Rothschild (1927–2012)

- Leonora de Rothschild (1837–1911)

- Lionel Nathan Rothschild (1808–1879)

- Louis Nathaniel de Rothschild (1882–1955)

- Lady Louise Rothschild (1821–1910), philanthropist and daughter of Henrietta Rothschild

- Countess Magdalene-Sophie von Attems (born 1927)

- Marie-Hélène de Rothschild (1927–94), French socialite

- Maurice de Rothschild (1881–1957)

- Mayer Amschel de Rothschild (1818–1874)

- Miriam Louisa Rothschild (1908–2005), famous entomologist and zoologist

- Lionel Walter Rothschild, 2nd Baron Rothschild, of Tring in the County of Hertford (1868–1937)

- Nathaniel de Rothschild (1812–1870)

- Nathan Mayer Rothschild (1777–1836)

- Nathan Mayer Rothschild, 1st Baron Rothschild, of Tring in the County of Hertford (1840–1915)

- Nathaniel Charles Jacob Rothschild, 4th Baron Rothschild, of Tring in the County of Hertford (born 1936)

- Nathaniel Robert de Rothschild (1946), French financier

- Nathaniel Mayer Victor Rothschild, 3rd Baron Rothschild, of Tring in the County of Hertford (1910–1990)

- Nathaniel Philip Rothschild (born 1971), a co-chairman of Atticus Capital, a £20 billion hedge fund[115]

- Nathaniel Anselm von Rothschild (1836–1905), Austrian socialite

- Sir Philip Sassoon, 3rd Baronet (1888–1939), British First Commissioner of Works and Under-Secretary of State for Air

- Count Philippe de Nicolay (born 1955), great-grandson of Salomon James de Rothschild, he is a director of the Rothschild group.[73]

- Robert de Rothschild (1880–1946) x 1907 : Gabrielle Beer (1886–1945)

- Philippe de Rothschild (1902–1988), vintner, son of Henri James de Rothschild

- Philippine de Rothschild (1935–2014), vintner, daughter of Philippe

- Jacqueline Rebecca Louise de Rothschild (1911–2012), chess and tennis champion

- Harry Primrose, 6th Earl of Rosebery (1882–1974) Earl of Roseberry

- Raphael de Rothschild (1976–2000)

- Salomon James de Rothschild (1835–1864)

- Lady Serena Dunn Rothschild (1935–2019)

- Countess Sophie von Löwenstein-Scharffeneck (1896–1978)

- Lady Sybil Grant (1879–1955), British writer

- Sybil Cholmondeley, Marchioness of Cholmondeley (1894–1989)

- Valentine Noémi von Springer (1886–1969)

- Victoria Katherine Rothschild (born 1953)

- Walter Rothschild, 2nd Baron Rothschild (1868–1937), zoologist

- Wilhelm Carl von Rothschild (1828–1901)

Prominent marriages into the family include, among many others:

- Maurice Ephrussi (1849–1916), of the Ephrussi family[116]

- Ben Goldsmith (born 1980), son of financier James Goldsmith, of the Goldsmith family married Kate Emma Rothschild (born 1982)

- Anita Patience Guinness (1957), of the Guinness family, married Amschel Mayor James Rothschild[117]

- Abraham Oppenheim (1804–1878), of the Oppenheim Family, married Charlotte Beyfus (1811–1887)

- Cora Guggenheim (1873–1956), of the Guggenheim family, married Louis F. Rothschild (1869–1957)

- Aline Caroline de Rothschild (1867–1909) married Edward Sassoon (1856–1912), of the Sassoon family

- Carola Warburg Rothschild (1894–1987), philanthropist, born into the Warburg family[118]

- Sara Louise de Rothschild (born 1834), married the Baron Raimondo Franchetti (born 1829)

- Baron Eugéne Daniel de Rothschild (1884–1976) married Countess Cathleen Wolff de Schönborn-Bucheim (1885 – c. 1946)[119]

- In 1923, James Nathaniel Charles Léopold Rothschild, son of Henri James Nathaniel Charles Rothschild and Mathilde Sophie Henriette de Weisweiller, married Claude du Pont of the Du Pont family.[120]

- Bertha Clara de Rothschild (1862) married Prince Alexandre de Wagram

- Bertha Juliet de Rothschild (1870) married Baron Emmanuel Leonino

- Lili Jeanette von Goldschimdt-Rothschild (1883–1929), married Baron Philippe Schey de Koromla

- Elisabeth Pelletier de Chambure (1902–1945), the only member of the Rothschild family to die in the Holocaust.

- Antoine Agénor Armand (1879–1962), of the Naples Rothschild lines, married Countess Élaine Greffulhe, daughter of Princess Élisabeth de Caraman-Chimay

- Hannah Mayer Rothschild (1815–1864) married Hon. Henry Fitzroy (1807–1859), of the family of the Dukes of Grafton

- Edouard Alphonse James de Rothschild (1868–1949) married in 1905 the Baroness Alice Germaine de Helphen (1884–1979)

- Count François de Nicolay (1919–1963), of the House of Nicolay, married Marie-Hélène Naila Stephanie Josina van Zuylen van Nyevelt

- Marguerite de Rothschild in 1878 married Antoine Alfred Agénor, 11th Duc de Gramont (1851–1921),

- Dorothy de Rothschild (1895–1988), on her death she left the largest probated estate in Britain

- George Herbert, 5th Earl of Carnarvon married Almina Victoria Maria Alexandra Wombwell, the illegitimate daughter of Alfred de Rothschild

- Pauline de Rothschild (1908–1976), fashion designer and translator of Elizabethan poetry

- Lady Irma Pauahi Wodehouse (1897), of the Wodehouse family[111]

- Louis Philippe Marie Alexandre Berthier, 3rd Prince of Wagram (1836–1911)

- Countess Katharina Eleonore Veronika Irma Luise Henckel von Donnersmarck (1902–1965), actress, married Baron Erich von Goldschmidt-Rothschild

- Amartya Sen (born 1933), Nobel Laureate, Indian economist and philosopher, married Emma Georgina Rothschild of the Rothschild banking family of England.

- Jeanne de Rothschild (1908–2003), actress

- Nadine de Rothschild (1932–), French actress and author

- Princess Sophie de Ligne (born 1957), of the House of Ligne, married Philippe de Nicolay (born 1955), a director of the Rothschild group,[73] and the great-grandson of Salomon James de Rothschild

- Liliane de Rothschild (1916–2003, née Fould-Springer), art collector

- David René de Rothschild married Princess Olimpia Anna Aldobrandini, of the House of Borghese and the House of Bonaparte.[111]

- Baron Robert Philippe de Rothschild married Nelly Beer, a great-grand-niece of Giacomo Meyerbeer

- Richard Francis Roger Yarde-Buller, 4th Baron Churston of Churston Ferrers and Lupton (1910–1991), married Olga Alice Muriel Rothschild

- Serena Dunn Rothschild (1935–2019), granddaughter of Sir James Hamet Dunn, 1st Baronet

- Lynn Forester de Rothschild (born 1954), businesswoman

- Edward Maurice Stonor (1885–1930), son of Francis Stonor, 4th Baron Camoys

- Lady Pamela Wellesley Grant (born 1912), great-great-granddaughter of the Duke of Wellington, married Lieutenant Charles Robert Archibald Grant, great-great-grandson of Mayer Amschel de Rothschild

- Baroness Rozsika Edle von Wertheimstein[8]

- Baron Etienne van Zuylen van Nyevelt of the House of Van Zuylen van Nyevelt – married Baroness Hélène de Rothschild (1863–1947).[121]

- Baron Sigismund von Springer (1873–1927), married Baroness Valentine Noémi von Rothschild (1886–1969), after whom the asteroid 703 Noëmi is named

- In 1943 Baron Elie Robert de Rothschild (1917–2007), married Lady Liliane Elisabeth Victoire Fould-Springer, great-aunt of actress Helena Bonham Carter[122]

- In 2015, James Rothschild married American heiress and socialite Nicky Hilton, the great-granddaughter of Hilton Hotels founder Conrad Hilton[123][124]

Coat of arms

|

|

See also

- List of European Jewish nobility

- List of wealthiest families

- Ascott House

- Avenue Foch

- Cecil John Rhodes

- Château de Montvillargenne

- Château de Pregny

- Château Lafite Rothschild

- Château Mouton Rothschild

- De Beers

- Eramet

- Genealogy of the Rothschild family

- Goût Rothschild

- Hôtel de Marigny

- Hôtel Salomon de Rothschild

- Hôtel Lambert

- The House of Rothschild (1934 film), addresses Rothschild roles in the Napoleonic era

- Imerys

- Napoleonic Wars

- Old money

- Palais Rothschild

- Rockefeller family

- Rothschild Island

- Rothschild (Fabergé egg)

- Rothschild properties in and around Buckinghamshire

- Rio Tinto Mining Group

- Vaux-de-Cernay Abbey

- Warburg family

Notes

- ↑ The Independent reported that he "shocked an audience by saying that in spite of 'the slow murder of 600,000 people' on the continent 'we probably all agree that there is something unsatisfactory in refugees encroaching on the privacy of our country, even for relatively short periods of time.'"

- ↑ The PICA obtained about 450–550 km2 (170–210 sq mi) of land in Palestine, out of about 1,850 km2 (710 sq mi) (7% of the area Mandatory Palestine) that were Jewish-owned by 1947. Today's Israel proper, excluding the West Bank, Gaza, Golan and East Jerusalem, is about 21,000 km2 (8,100 sq mi), but the Mandatory Palestine was larger.

References

- ↑ "Lord Rothschild: 'Investors face a geopolitical situation as dangerous as any since WW2'". Telegraph.co.uk. 4 March 2015. Archived from the original on 10 January 2022.

- ↑ Elon, Amos (1996). Founder: Meyer Amschel Rothschild and His Time. New York: HarperCollins. ISBN 978-0-00-255706-1.

- ↑ Backhaus, Fritz (1996). "The Last of the Court Jews – Mayer Amschel Rothschild and His Sons". In Mann, Vivian B.; Cohen, Richard I. (eds.). From Court Jews to the Rothschilds: Art, Patronage, and Power 1600–1800. New York: Prestel. pp. 79–95. ISBN 978-3-7913-1624-6.

- ↑ Rubinstein, William D.; Jolles, Michael; Rubinstein, Hilary L. (2011). The Palgrave Dictionary of Anglo-Jewish History. Palgrave Macmillan. ISBN 9780230304666.

- ↑ Leeson, Robert (2014). Hayek: A Collaborative Biography: Part II, Austria, America and the Rise of Hitler, 1899-1933. Springer Publishing. p. 27. ISBN 9781137325099. Archived from the original on 26 March 2023. Retrieved 26 June 2019.

- 1 2 The House of Rothschild: Money's prophets, 1798–1848, Volume 1, Niall Ferguson, 1999, page 481-85

- ↑ "The Rothschild story: A golden era ends for a secretive dynasty". The Independent. Archived from the original on 15 January 2006.

- 1 2 The Secret Life of the Jazz Baroness, from The Times 11 April 2009, Rosie Boycott

- ↑ Rothschild: a story of wealth and power, by Derek A. Wilson, (Deutsch 1988), pages 415–456

- 1 2 The Rothschilds: Portrait of a Dynasty, By Frederic Morton, page 11

- 1 2 Robert Booth (8 July 2011). "Million-pound bash for rising star of the super-rich". The Guardian. London. Archived from the original on 5 May 2021. Retrieved 13 December 2016.

- 1 2 McConnachie, James; Tudge, Robin (2008). The Rough Guide to Conspiracy Theories (Second ed.). London: Rough Guides Ltd. p. 244-246. ISBN 9781858282817.

- ↑ Pohl, Manfred (2005), "Rothschild, Mayer Amschel", Neue Deutsche Biographie (in German), vol. 22, Berlin: Duncker & Humblot, pp. 131–133

- ↑ "Concordia, Integritas, Industria – The Rothschilds – LCF Rothschild Group". Lcf-rothschild.com. Archived from the original on 24 October 2007. Retrieved 8 July 2010.

- ↑ Paul Johnson, A History of the Jews, p.317.

- ↑ The House of Rothschild (Vol. 2): The World's Banker: 1849–1999, Niall Ferguson (2000)

- ↑ Jewish Encyclopedia c. 1906 Finance Archived 28 June 2011 at the Wayback Machine

- ↑ Go Ahead, Kiss Your Cousin Archived 15 December 2017 at the Wayback Machine by Richard Conniff, From the August 2003 issue, published online 1 August 2003

- ↑ "Rothschild". Verwandt.de. Archived from the original on 6 May 2016. Retrieved 29 April 2019.

- 1 2 3 Constantin von Wurzbach (1874). Biographisches Lexikon des Kaiserthums Oesterreich (in German). Vienna: Zamarski. p. 120. Archived from the original on 26 March 2023. Retrieved 26 February 2018.

- ↑ The Genealogy of the Existing British Peerage and Baronetage, By Edmund Lodge, Hurst and Blackett, 1859, page 808

- 1 2 "No. 25486". The London Gazette. 3 July 1885. p. 3060.

- 1 2 3 4 Victor Gray and Melanie Aspey, "Rothschild, Nathan Mayer (1777–1836)" Archived 26 March 2023 at the Wayback Machine, Oxford Dictionary of National Biography, Oxford University Press, September 2004; online edition, May 2006. Retrieved 21 May 2007.

- 1 2 3 4 The Ascent of Money: A Financial History of the World, (London 2008), page 78.

- 1 2 3 Victor Rothschild – "The Shadow of a Great Man" in Random Variables, Collins, 1984.

- 1 2 3

- Ferguson, Niall. The World's Banker: The History of the House of Rothschild. Weidenfeld & Nicolson, 1998, ISBN 0-297-81539-3

- ↑ "Brief history of the London house, N M Rothschild & Sons". The Rothschild Archive. Retrieved 29 September 2021.

- ↑ "Records of the Rothschild banking and finance business. Private records of Rothschild family members and their estates. – Archives Hub". archiveshub.jisc.ac.uk. Archived from the original on 26 March 2023. Retrieved 29 September 2021.

- ↑ Philip Ziegler, The Sixth Great Power: Barings, 1726–1929, (London 1988), pp.94f

- 1 2 3 4 Shaw, Caroline S. (2005). "Rothschilds and Brazil: An Introduction to Sources in the Rothschild Archive" (PDF). Latin American Research Review. Austin. 40: 165–185. doi:10.1353/lar.2005.0013. S2CID 144998736. Archived from the original (PDF) on 21 September 2013. Retrieved 20 September 2013.

- ↑ 1634–1699: McCusker, J. J. (1997). How Much Is That in Real Money? A Historical Price Index for Use as a Deflator of Money Values in the Economy of the United States: Addenda et Corrigenda (PDF). American Antiquarian Society. 1700–1799: McCusker, J. J. (1992). How Much Is That in Real Money? A Historical Price Index for Use as a Deflator of Money Values in the Economy of the United States (PDF). American Antiquarian Society. 1800–present: Federal Reserve Bank of Minneapolis. "Consumer Price Index (estimate) 1800–". Retrieved 28 May 2023.

- ↑ "Two Great Foreign Fortunes". No. 3–21–1907. The Spanish Fork Press. University of Utah. 21 March 1907. Archived from the original on 11 February 2022. Retrieved 11 February 2022.

- ↑ "1, Seamore Place, London, England". Rothschild Archive. Retrieved 27 March 2017.

- ↑ "Rothschild and Brazil – the online archive". Information Bureau. The Rothschild Archive. Archived from the original on 4 February 2011. Retrieved 20 September 2013.

- ↑ The Rio Tinto Company: an economic history of a leading international mining concern, Charles E. Harvey (1981), page 188

- ↑ Smethurst, Richard. "Takahasi Korekiyo, the Rothschilds and the Russo-Japanese War, 1904–1907" (PDF). Archived from the original (PDF) on 16 February 2007. Retrieved 4 September 2007.

- ↑ A History of the Jews, Paul Johnson (London 2004), page 319–320

- ↑ Weekly Register. 1836. p. 41. Archived from the original on 26 March 2023. Retrieved 22 November 2015.

- ↑ House of Rothschild : Money's Prophets: 1798–1848 by Niall Ferguson. Viking Press (1998) ISBN 0-670-85768-8

- ↑ "Baron Guy de Rothschild, Leader of French Arm of Bank Dynasty, Dies at 98". The New York Times. 14 June 2007. Archived from the original on 8 March 2021. Retrieved 12 February 2017.

- ↑ Meyer, William H. (4 December 1988). "Meagdealer For The Rothschilds". The New York Times. Archived from the original on 22 May 2014. Retrieved 21 May 2014.

- ↑ "No. 20684". The London Gazette. 18 December 1864. p. 5885.

- ↑ Brief history of the London house, N M Rothschild & Sons at Rothschild Archive website, 2020. Retrieved 10 August 2020

- ↑ RPT-French banker Guy de Rothschild dies aged 98 Archived 6 February 2021 at the Wayback Machine Reuters, 14 June 2007

- ↑ Lafite; the story of Château Lafite-Rothschild, by Cyril Ray (NY 1969), page 66.

- ↑ Lewis, Paul (14 June 2007). "Baron Guy de Rothschild, Leader of French Arm of Bank Dynasty, Dies at 98". New York Times. Archived from the original on 8 March 2021. Retrieved 12 February 2017.

- ↑ Faith, Nicholas (4 November 1997). "Obituary: Baron Edmond de Rothschild". The Independent. London. Archived from the original on 12 April 2020. Retrieved 29 March 2009.

- ↑ Gilbert Trigano, a Developer of Club Med, Is Dead at 80 By JOHN TAGLIABUE Published: 6 February 2001

- ↑ Thomas Trenkler. Der Fall Rothschild: Chronik einer Enteignung. Czernin Verlag, Vienna. 1999. ISBN 3-85485-026-3

- ↑ Vogel, Carol (10 April 1999). "Austrian Rothschilds Decide to Sell; Sotheby's in London Will Auction $40 Million in Art Seized by Nazis". New York Times. Archived from the original on 8 March 2021. Retrieved 1 June 2013.

- ↑ The reign of the house of Rothschild, Egon Caesar Corti (Conte), 1928, page 46

- ↑ "Rothschild" Archived 14 February 2015 at the Wayback Machine. Jewish Encyclopedia, 1901–1906, Vol. 2, p. 497.

- ↑ "Balfour Declaration." (2007). In Encyclopædia Britannica. Retrieved 12 August 2007, from Encyclopædia Britannica Online Archived 9 November 2015 at the Wayback Machine.

- 1 2 Vallely, Paul (16 April 2004). "The Rothschild story: A golden era ends for a secretive dynasty". The Independent. London. Archived from the original on 9 July 2008. Retrieved 18 February 2010.

- ↑ Aharonson, Ran (2000). Rothschild and early Jewish colonization in Palestine. Israel: The Hebrew university Magnes Press, Jerusalem. p. 53. ISBN 978-0-7425-0914-6.

- ↑ Aharonson, Ran (2000). Rothschild and early Jewish colonization in Palestine. Israel: The Hebrew university Magnes Press, Jerusalem. p. 54. ISBN 978-0-7425-0914-6.

- ↑ Aumann, Moshe. "Land Ownership in Palestine, 1880–1948". Survival of a Nation. The Rohr Jewish Learning Institute. Archived from the original on 14 December 2020. Retrieved 23 July 2021.

- ↑ Encyclopedia of Zionism and Israel, vol. 2, "Rothschild, Baron Edmond-James de," p. 966

- ↑ Greenwood, Naftali. "The Redeemers of the Land". Israel Ministry of Foreign Affairs. Archived from the original on 15 May 2010. Retrieved 8 April 2010.

- ↑ "James Armand de Rothschild on the Knesset web site". Knesset.gov.il. Archived from the original on 8 March 2021. Retrieved 8 July 2010.

- ↑ "Dorothy de Rothschild, 93, Supporter of Israel" Archived 26 March 2023 at the Wayback Machine (obituary), The New York Times, 13 December 1988. Retrieved 19 June 2008.

- ↑ "The Presidents Chamber". Tour of Supreme Court. The Judicial Authority of the State of Israel. Archived from the original on 26 May 2021. Retrieved 23 July 2021.

- 1 2 "Family values", Haaretz, Magazine, 11:15 05.11.10, By Eytan Avriel and Guy Rolnik

- ↑ Magen, Hadas (31 May 2015). "Baroness Rothschild: Israel insults our family" Archived 2 June 2015 at the Wayback Machine. Globes.

- ↑ Personal email correspondence between Pardes Hannah Rishonim Museum representative and Wikipedia editor, April 2022| "This [identification of Hanna Primrose as the source of the name given to Pardes Hanna] is information that was provided to the Pardes Hannah Rishonim Museum in the 1980s after a clarification was conducted at that time with the Rothschild family archives in London. Hannah Primrose's picture which hangs in the Rishonim Museum also came from the same source... We are aware that there are those who attribute the name to other women. The claims we receive usually rely on some measure of logic but not on information that has been confirmed."

- ↑ rishonim.house| Pardes Hanna-Karkur Founders' House Museum

- ↑ מקור השם פרדס חנה. Pardes Hana Karkur (in Hebrew). Archived from the original on 6 October 2022. Retrieved 15 September 2022.

- ↑ Ramat HaNadiv official site: section on the Rothschilds on the map of the Land of Israel Archived 4 August 2022 at the Wayback Machine (Hebrew)

- ↑ "Banking activities organisation chart of Rothschild". Paris-orleans.com. Archived from the original on 25 March 2012.

- ↑ "Paris Orléans Annual report 2007/2008" (PDF). Paris-orleans.com. Archived from the original (PDF) on 25 March 2012. Retrieved 31 July 2008.

- ↑ "Rothschild and Rabobank establish global food and agri co operation". Rabobank. Archived from the original on 5 February 2009.

- ↑ "Rothschild sells 7.5% stake to Rabobank". Financial Times. 2008. Archived from the original on 5 February 2009. Retrieved 20 November 2008.

- 1 2 3 People: Paris Orleans S.A. (PROR.PA) Archived 25 September 2015 at the Wayback Machine Reuters.

- ↑ "League tables". Rothschild.com. Archived from the original on 23 August 2002. Retrieved 8 July 2010.

- ↑ Annual Report of N M Rothschild & Sons Limited for the year ended 31 March 2006.

- ↑ The House of Rothschild: Money's prophets, 1798–1848, Volume 1, Niall Ferguson, 1999, p. 3.

- ↑ Hei Hu Quan (11 August 2011). "Undeleted Evidence…". undeletedevidence.blogspot.com. Archived from the original on 17 November 2011. Retrieved 19 October 2011.

- ↑ "RIT Capital Partners". Miranda.hemscott.com. 28 October 2003. Archived from the original on 25 August 2004. Retrieved 8 July 2010.

- ↑ Lord Rothschild fund joins World Gold Council to put £12.5m into BullionVault Archived 14 November 2017 at the Wayback Machine The Daily Telegraph (London), Garry White, 20 June 2010

- ↑ Rothschild's RIT Capital Boosts Gold Investments as Net Asset Value Climbs Bloomberg, 17 November 2010

- ↑ Rockefellers and Rothschilds unite Archived 31 May 2012 at the Wayback Machine Financial Times (London), Daniel Schäfer, 29 May 2012

- ↑ Transatlantic alliance between Rothschilds and Rockefellers for wealth management Archived 12 April 2020 at the Wayback Machine Tom Bawden, Thursday 31 May 2012, The Independent (London)

- ↑ Peippo, Kathleen (2000). "St. James's Place Capital, plc, International Directory of Company Histories, Find Articles at BNET.com". Findarticles.com. Archived from the original on 8 July 2012. Retrieved 8 July 2010.

- ↑ If you have to ask the price The Daily Telegraph (London), Ross Clark, 1 August 2001

- ↑ Rothschild backs North Sea oil trio Archived 11 June 2011 at the Wayback Machine, Sunday Times 6 December 2009

- ↑ Bloomberg Businessweek, Glencore May Expand to Rival BHP, Rothschild Says 6 January 2010, Simon Casey

- ↑ "James de Rothschild, le banquier de l'ère industrielle". Le Monde.fr. 16 August 2013. Archived from the original on 21 August 2013. Retrieved 31 August 2013.

- ↑ "Rothschild.info – WINE". rothschild.info. Archived from the original on 25 September 2003.

- ↑ "Jancis Robinson on Saskia de Rothschild, new head of Château Lafite". Financial Times. 15 June 2018. Archived from the original on 10 December 2022. Retrieved 4 April 2022.

- ↑ "Philippe Sereys de Rothschild takes over the family business". Financial Times. 10 July 2015. Archived from the original on 10 December 2022. Retrieved 4 April 2022.

- ↑ The Rothschilds: Portrait of a Dynasty, By Frederic Morton, page 11-13

- ↑ "Hannah Rothschild appointed Chair of the National Gallery's Board of Trustees". nationalgallery.org.uk. Archived from the original on 12 April 2020. Retrieved 10 December 2014.

- ↑ The Daily Telegraph (London), The Rothschilds: They prefer to let their money do the talking, William Langley, 25 October 2008

- ↑ Rothschild and Rockefeller: their family fortunes Archived 16 February 2018 at the Wayback Machine Harry Mount, 30 May 2012, The Daily Telegraph (London)

- ↑ "Fiddler On The Roof – Tradition Lyrics". Lyrics Mania. Archived from the original on 2 November 2015. Retrieved 2 November 2015.

- ↑ The Rothschilds: Portrait of a Dynasty, By Frederic Morton (1998), page 5

- ↑ Ferguson, ch.1

- ↑ Levy, Richard S. (2005). Antisemitism: A Historical Encyclopedia of Prejudice. ABC-CLIO. p. 624. ISBN 978-1-85109-439-4.

- ↑ Poliakov, Leon (2003). The History of Anti-semitism: From Voltaire to Wagner. University of Pennsylvania Press. p. 343. ISBN 978-0-8122-1865-7.

- ↑ Brustein, William (2003). Roots of hate. Cambridge University Press. p. 147. ISBN 978-0-521-77478-9.

- ↑ Perry, Marvin (2002). Antisemitism: Myth and Hate from Antiquity to the Present. Palgrave Macmillan. p. 117. ISBN 978-0-312-16561-1.

- ↑ The Ascent of Money: A Financial History of the World, (London 2008), page 91.

- ↑ Jovan Byford (2011). Conspiracy Theories: A Critical Introduction. Palgrave Macmillan. p. 104. ISBN 9780230349216.

... a further and more direct link with the conspiracy culture's antisemitic apparent in the treatment of the Rothschild family. Ever since the nineteenth century, the Rothchilds, who combined Jewishness, financial wealth and international connections, have been the epitome of the international Jewish conspiracy (Barkun, 2006). The family name continues to feature in conspiratorial narratives to the present day, although writers of the post-1945 era have tended to play down their importance.

- ↑ Markku Ruotsila (2003). "Antisemitism". In Peter Knight (ed.). Conspiracy Theories in American History: An Encyclopedia. ABC-CLIO. p. 82. ISBN 9781576078129.

This new economic antisemitism issued in a variety of full-blown conspiracy theories in the 1870s through the 1890s. In these conspiracy theories all the perceived evils of modern capitalism and industrialism were ascribed to Jews, ... and, on a more precise level, because of the purported machinations of identifiable Jewish financiers. The latter type of theories tended to centre around the supposed power of the Rothschild banking family and those of its U.S. agents that were central in various reconstruction and public debt refinancing schemes after the Civil War...

- ↑ Richard Allen Landes and Steven T. Katz (2012). The Paranoid Apocalypse: A Hundred-year Retrospective on the Protocols of the Elders of Zion. NYU Press. p. 189. ISBN 9780814749456.

... there are anti-Semitic claims of a vast conspiracy by Jews that structurally replicate the Protocols without mentioning the hoax document. Another way conspiracy theories try to avoid the label of anti-Semitic is to argue that there is a vast conspiracy by the "Rothschild family" or the "Khazars" or some other entity...

- ↑ David Norman Smith (2013). "Anti-Semitism". In Carl Skutsch (ed.). Encyclopedia of the World's Minorities. Vol. 1 (A-F). Routledge. p. 110. ISBN 9781135193881.

The great banking barons of the Rothschild family became, in anti-Semitic fantasy, living emblems of Jews everywhere. ... For anti-Semites, socialism and bank capitalism are just two sides of the Jewish conspiracy against order and tradition...

- ↑ Michael Streeter (2008). Behind Closed Doors: The Power and Influence of Secret Societies. New Holland Publishers. pp. 146–47. ISBN 9781845379377.

When it comes to conspiracy theories and the secret societies that supposedly run out world ... The finger of suspicion often points to bankers and Jews – and often to Jewish bankers – as the moneymen behind this world plot. Chief among the 'suspects' are the Rothschilds, the Jewish banking dynasty ... Yet there is little or nothing that the Rothschild bankers have done that is not perfectly explicable by normal banking practices. ... The fact that the Rothschilds feature at the centre of so many conspiracy theories is perhaps no coincidence. For it is sadly the case that many claims alleging secret societies have contained more than a tinge of anti-Semitism.

- ↑ Nicholas Goodrick-Clarke (2002). Black Sun: Aryan Cults, Esoteric Nazism, and the Politics of Identity. NYU Press. p. 296. ISBN 9780814732373.

[Conspiracy theorist Jan van] Helsing's dubious sources, his constant repetition of Jewish names as members of private and public organizations, and above all his emphasis on the assets and powerbroking influence of the Rothschilds as the top Illuminati family leave no doubt that his conspiracy theories are aimed at Jewish targets.

- ↑ Morton, Fredreric (1962)The Rothschilds; A Family Portrait, Secker & Warburg;London, UK

- ↑ Burke's Peerage, Baronetage & Knightage-96th Ed-1938

- 1 2 3 1.[S37] Charles Mosley, editor, Burke's Peerage, Baronetage & Knightage, 107th edition, 3 volumes (Wilmington, Delaware, U.S.A.: Burke's Peerage (Genealogical Books) Ltd, 2003), volume 3, page 3416. Hereinafter cited as Burke's Peerage and Baronetage, 107th edition.

- ↑ Francesco Rapazzini, Élisabeth de Gramont, Paris, Fayard, 2004.

- ↑ Eco-warrior sets sail to save oceans from 'plastic death' Archived 26 February 2017 at the Wayback Machine The Observer (London), 12 April 2009, Robin McKie

- ↑ "Anne-Myriam Dutrieue, Le baron Léon Lambert, un banquier et financier belge d'envergure internationale du XXe siècle, 2010" (PDF). Archived (PDF) from the original on 26 October 2020. Retrieved 29 April 2019.

- ↑ The Rothschilds and their 200 years of political influence Archived 1 September 2017 at the Wayback Machine Andy McSmith, 23 October 2008, The Independent (London)